Loading

Get Ca Ftb 199 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 199 online

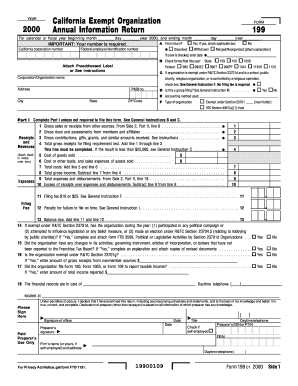

This guide provides a comprehensive walkthrough for completing the California Exempt Organization Annual Information Return (Form 199) online. Whether you are new to tax forms or looking to ensure accuracy, this guide offers clear steps for each section.

Follow the steps to successfully complete Form 199.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your organization’s California corporation number or federal employer identification number in the designated fields.

- Indicate whether your organization is dissolved, withdrawn, or merged by checking the applicable box.

- Provide your organization’s name, address, and, if applicable, fill in the PMB number.

- Select the accounting method used and specify the type of organization by checking the appropriate box.

- Complete Part I by providing gross sales or receipts, gross dues, and gross contributions as applicable.

- Calculate total gross receipts and ensure it meets the filing requirements based on the reported values.

- If your organization has incurred expenses, complete the relevant sections for cost of goods sold, total income, and expenses.

- Address any questions regarding political or legislative activities, and confirm if any changes in the organization’s structure or activities occurred.

- Ensure to review all entries for accuracy before signing the form at the designated place.

- Finalize your form by saving your changes. You may then download, print, or share the completed form as needed.

Complete your FTB 199 form online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

California FTB form 199 is the annual tax return form for exempt organizations in California. This form allows eligible organizations to report their activities and ensures compliance with state tax regulations. Filing the CA FTB 199 accurately helps to avoid penalties and protects your organization's tax-exempt status.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.