Get Ma Schedule Ec 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Schedule EC online

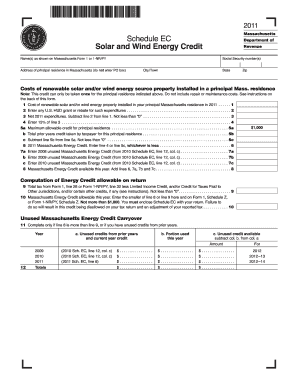

The MA Schedule EC is a valuable tax form for homeowners who have invested in renewable energy sources such as solar and wind energy systems. This guide provides a step-by-step approach to filling out the MA Schedule EC online, ensuring that users can easily navigate the process and claim their eligible credits.

Follow the steps to complete your MA Schedule EC online.

- Press the ‘Get Form’ button to access the form and open it in your chosen editor.

- Enter your name(s) as shown on Massachusetts Form 1 or 1-NR/PY. Make sure to input the correct spelling to ensure accuracy in processing your tax form.

- Provide your Social Security number(s) in the designated field. It is crucial to enter this information accurately to avoid any delays.

- Fill in the address of your principal residence in Massachusetts. Do not use a PO box; provide the actual street address.

- List the costs of renewable solar and/or wind energy property that you installed in your principal Massachusetts residence during the year. Remember to exclude any repair or maintenance costs.

- Enter any U.S. HUD grant or rebate you received for such expenditures. This value will help you calculate your net expenditures.

- Calculate your net 2011 expenditures by subtracting the grant or rebate amount from your total costs of renewable energy property.

- Enter 15% of the net expenditures. This figure helps determine your potential energy credit.

- Identify the maximum allowable credit of $1,000 for your principal residence. Note that you can only claim this credit once for the specified residence.

- Declare any prior year credits taken for this residence. This will affect your current year's allowable credit.

- Subtract the total prior credits from the maximum allowable credit to find out how much you can claim for this tax year.

- Follow the calculations provided to determine your 2011 Massachusetts energy credit. Enter the lesser amount between the calculated figure and the maximum credit allowed.

- If you have unused Massachusetts energy credits from previous years, list them in the provided fields for carryover.

- Make sure to review your entries for accuracy and completeness before proceeding.

- Finally, save your changes, and download, print, or share the completed form as necessary.

Start completing your MA Schedule EC online today to take advantage of your renewable energy credits.

Get form

The purpose of Schedule E is to provide a comprehensive format for reporting particular types of income, including rental and royalty income. This form helps taxpayers calculate their total taxable income from these sources. Utilizing the MA Schedule EC can enhance your understanding of potential deductions and credits available related to your reported income.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.