Loading

Get Ma Schedule C 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Schedule C online

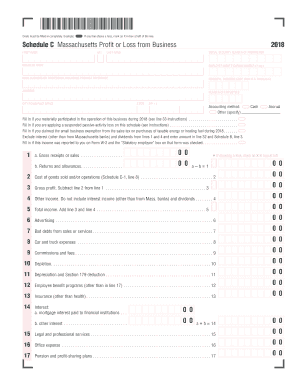

Filling out the MA Schedule C is an essential step for individuals reporting profit or loss from business activities in Massachusetts. This guide provides clear, step-by-step instructions to help users navigate the online form effectively.

Follow the steps to fill out the MA Schedule C online with ease.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin with the first section, entering your first name, middle initial, last name, and social security number. This information identifies you as the business proprietor.

- Next, provide your business name, employer identification number, if applicable, and the main business or profession, including products or services offered.

- Indicate your principal business code, which corresponds to your type of business, and fill in your business address, including the city, state, and zip code.

- Specify your accounting method by selecting either cash or accrual, and provide information regarding your participation in the business and any necessary tax exemptions.

- In the income section, fill out Gross Receipts or Sales, Returns and Allowances, and compute your Total Income by adding Gross Profit and Other Income.

- Proceed to the expenses section, detailing all relevant costs including advertising, car and truck expenses, and other deductibles.

- After completing all income and expense entries, calculate your Net Profit or Loss and include any relevant information about investment risk.

- Review all entries for accuracy and completeness before finalizing the form.

- Once complete, save your changes, download, print, or share the form as needed.

Begin filling out your MA Schedule C online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A qualified business for MA Schedule C is one that operates for profit, retaining a structure that allows for it to be treated as a sole proprietorship. This includes freelance work, consulting services, and small businesses operated without formal incorporation. Properly classifying your business is essential for accurate tax reporting and compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.