Get Ca Ftb 199 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 199 online

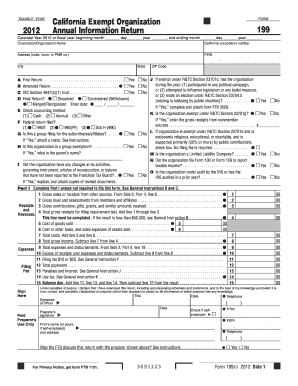

Filling out the CA FTB 199 form is an essential step for California exempt organizations to report their annual information accurately. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring that users can easily navigate each section and field without confusion.

Follow the steps to successfully complete the CA FTB 199 online.

- Click the ‘Get Form’ button to obtain the CA FTB 199 form. This action will allow you to open the form in an appropriate text editor.

- Begin by entering the taxable year at the top of the form. Indicate whether the form is for calendar year 2012 or for a fiscal year by filling in the relevant dates.

- In the first section, provide the corporation or organization name, California corporation number, address, and FEIN (Federal Employer Identification Number). Ensure all information is accurate and matches previous filings.

- Indicate if this is the first return, an amended return, or if the organization falls under IRC Section 4947(a)(1). This will help determine the correct reporting requirements.

- Specify if the return is final by marking the appropriate box if the organization has dissolved, surrendered, or merged. Follow the prompts for additional information if necessary.

- Select the accounting method by checking either cash, accrual, or another method. If applicable, input gross receipts from non-member sources.

- Indicate whether a federal return has been filed by selecting the appropriate box (e.g., 990T, 990(PF), or Sch H (990)).

- Continue with the remaining sections by filling in information related to gross receipts, income, expenses, and disbursements as prompted. Pay attention to detail and ensure calculations are accurate.

- Review the filing fee and ensure you have completed all required fields. Check the totals for accuracy.

- Once all sections are complete, you can save your changes, download a copy of the form, print it for your records, or share it as needed.

Complete your CA FTB 199 form online today to ensure compliance with California tax regulations.

Get form

Related links form

If you earned income from California sources as a nonresident, you likely need to file a California nonresident tax return, which may include form 199. This requirement helps ensure that you meet your tax obligations based on the income generated in the state. Not filing could lead to fines and complications with the California Franchise Tax Board. For more detailed help, explore the resources available on the US Legal Forms platform.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.