Get Ma Dor M-1310 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR M-1310 online

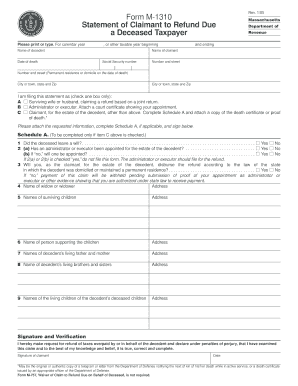

Filling out the MA DoR M-1310 form is an essential step for individuals seeking a tax refund for a deceased taxpayer. This guide provides clear, step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to fill out the MA DoR M-1310 form online.

- Click ‘Get Form’ button to access the MA DoR M-1310 form and open it for editing.

- Begin filling out the form by entering the name of the decedent and the date of death in the designated fields. Ensure this information is accurate as it is crucial for the claim.

- Provide your full name as the claimant and include your social security number. This helps to identify you as the person submitting the request for a refund.

- Specify your permanent address, including the number and street, city or town, state, and zip code. This information confirms your residence at the time of the decedent’s passing.

- Indicate your relationship to the decedent by selecting one option from the provided boxes. Choose from surviving spouse, administrator or executor, or claimant for the estate.

- If you selected option C, complete Schedule A, which includes questions about the decedent’s will, appointment of an administrator or executor, and disbursement of the refund. Respond accurately to ensure compliance with appropriate laws.

- Fill in the names and addresses of the decedent’s surviving children, spouse, parents, siblings, and any other relevant relatives as prompted on the form.

- Read the section concerning the signature and verification carefully. After ensuring all the information provided is accurate, sign the form, date it, and submit it according to the specified instructions.

- Once you have completed the form and verified all entries, you can save your changes, download a copy for your records, and print or share the completed form as needed.

Begin the process of filing documents online to ensure timely refunds and accurate processing.

Get form

Related links form

Filing a final tax return for a deceased person involves using Form 1040 and indicating the taxpayer's date of death. You will need to gather all relevant income documentation and report it within the appropriate tax year. If you're uncertain about the process, using platforms like uslegalforms can provide you with resources to simplify this task. Be mindful of the deadlines and the information needed, including the MA DoR M-1310 guidelines.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.