Loading

Get Ma Dor Ifta-1 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR IFTA-1 online

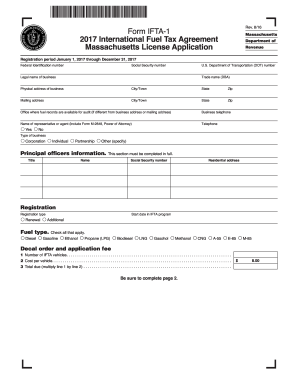

Filling out the MA DoR IFTA-1 form is an essential step for those participating in the International Fuel Tax Agreement in Massachusetts. This guide provides detailed instructions to help users navigate the form efficiently and accurately.

Follow the steps to complete the MA DoR IFTA-1 online form.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Enter your federal identification number or, if one is not issued, provide your social security number.

- Fill in the U.S. Department of Transportation (DOT) number for any trucks that go interstate and are over 10,000 pounds.

- Provide the legal name of your business as it appears on official documents, along with any trade name (DBA) if applicable.

- Complete the physical address of your business, including city, state, and zip code.

- Fill in the mailing address where you wish to receive your license and decals.

- If your office for fuel records is different, provide that address.

- Enter your business telephone number and, if applicable, provide the name and telephone number of your representative or agent.

- Select the type of business from the given options: Corporation, Individual, Partnership, or Other.

- Complete the principal officers section with names, titles, social security numbers, and residential addresses.

- Indicate the registration type as either Renewal, New, or Additional.

- Check all fuel types used by your business.

- Enter the number of IFTA vehicles and multiply by the cost per vehicle to find the total due.

- Fill in the jurisdictions where you travel by checking the appropriate ovals.

- If you maintain bulk storage, indicate Yes and list the relevant jurisdiction.

- State any IFTA jurisdictions you are currently registered with or have been registered previously.

- Answer whether your IFTA license has ever been revoked and list any jurisdictions where it is currently revoked.

- Complete the declaration by signing, entering your title, and the date.

- Ensure that all fields are filled, make the remittance in U.S. funds, and mail to the specified address.

Complete your application online for a smoother submission process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To obtain your IFTA report, log in to your MA DoR IFTA account and navigate to the report section. You can generate your quarterly fuel tax reports directly from the system. Alternatively, using US Legal Forms can simplify the process by providing templates that streamline your reporting needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.