Loading

Get Ma Dor Ifta-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR IFTA-1 online

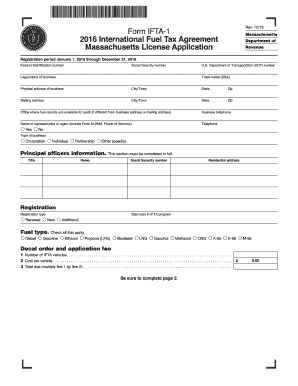

Filling out the MA DoR IFTA-1 form is essential for businesses engaged in interstate fuel use. This guide provides detailed, step-by-step instructions for users of all experience levels to successfully complete the application online.

Follow the steps to fill out the MA DoR IFTA-1 form online.

- Click the ‘Get Form’ button to access the application form and open it for editing.

- Enter your federal identification number or social security number in the appropriate field. This information is required to identify your business.

- Provide your U.S. Department of Transportation (DOT) number if your trucks are interstate and over 10,000 pounds.

- Enter the legal name of your business. This should match the name on your formation documents or ownership records.

- Input your trade name (doing business as) if applicable. This helps to establish your account.

- Fill in the physical address of your business, including the city, state, and zip code.

- Provide your mailing address. This is where you will receive your license, decals, and returns.

- Indicate where your fuel records are available for audit if this is different from your business or mailing address.

- Enter your business telephone number for contact purposes.

- Complete the section for your representative or agent if you are granting Power of Attorney. Ensure to include the necessary documentation.

- Select your type of business from the options provided: Corporation, Individual, Partnership, or Other. Make sure to provide any requested details.

- Include information about principal officers of the business, including their titles, names, social security numbers, and residential addresses.

- Choose the registration type: Renewal, New, or Additional, depending on your circumstance.

- Indicate the types of fuel used by checking all applicable boxes.

- Specify the number of IFTA vehicles and calculate the total fee by multiplying the number of vehicles by the cost per vehicle.

- Fill in the jurisdictions where you travel by marking the appropriate ovals.

- Indicate whether you maintain bulk storage and provide the relevant jurisdiction if applicable.

- List any jurisdiction(s) where you have previously registered for IFTA.

- Answer whether your IFTA license has ever been revoked and provide details accordingly.

- Sign and date the application, ensuring that it is completed by an authorized person.

- Review your application to ensure all sections are filled out completely, verify the check amount, and confirm that it is signed.

- Once completed, save your changes, and you can choose to download, print, or share the form as necessary.

Complete your MA DoR IFTA-1 application online today to ensure compliance and maintain your operating privileges.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You know you have IFTA if your vehicles are registered for IFTA and you travel across state lines for commercial purposes. If your vehicles exceed the weight threshold or fall into specific categories, you must participate. If unsure, reviewing your registration documents or checking with the MA DoR can clarify your status.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.