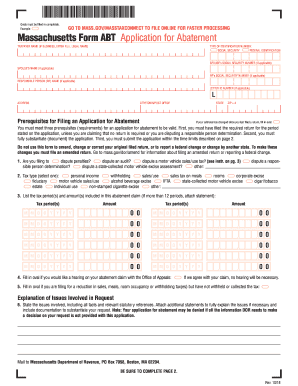

Get Ma Dor Abt 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MA DoR ABT online

How to fill out and sign MA DoR ABT online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Reporting your income and submitting all essential tax documents, including MA DoR ABT, is solely the responsibility of a US citizen.

US Legal Forms simplifies your tax management, making it more convenient and precise.

Safeguard your MA DoR ABT. Ensure that all your necessary documents and information are appropriately organized while observing the deadlines and tax regulations set by the Internal Revenue Service. Make it simple with US Legal Forms!

- Access MA DoR ABT in your web browser from your device.

- Click to open the fillable PDF document.

- Begin filling out the template field by field, following the prompts of the advanced PDF editor's interface.

- Carefully enter text and figures.

- Choose the Date field to automatically set today's date or adjust it manually.

- Utilize Signature Wizard to create your personalized e-signature and authenticate within minutes.

- Consult the Internal Revenue Service guidelines if you have any remaining questions.

- Select Done to save your changes.

- Proceed to print the document, download it, or send it via email, text message, fax, or USPS without leaving your web browser.

How to adjust Get MA DoR ABT 2018: personalize forms online

Opt for a trustworthy document modification solution that you can rely on. Amend, process, and endorse Get MA DoR ABT 2018 securely online.

Frequently, dealing with documents, such as Get MA DoR ABT 2018, can be troublesome, particularly if you received them online or through email but lack access to specialized tools. While you might discover some alternatives to navigate the issue, you risk obtaining a document that fails to comply with submission standards. Relying on a printer and scanner isn’t feasible either as it's time- and resource-intensive.

We offer a more straightforward and efficient method for file alterations. An extensive collection of document templates that are easy to modify and verify, to make fillable for others. Our service goes well beyond a mere assortment of templates. One of the top advantages of using our service is the ability to adjust Get MA DoR ABT 2018 directly on our website.

As an online service, it eliminates the need for downloading any computer applications. Additionally, not all organizational policies permit you to install programs on your work computer. Here’s the ideal method to easily and securely manage your documents with our platform.

Move away from inefficient paper-based modification methods for your Get MA DoR ABT 2018 or other documents. Instead, adopt our solution, which features one of the most extensive libraries of customizable forms and a powerful document editing platform. It's straightforward and secure and can save you significant time! Don’t just take our word for it, experience it for yourself!

- Click the Get Form > you’ll be promptly directed to our editor.

- Once opened, you can begin the customization procedure.

- Choose checkmark or circle, line, arrow, and cross along with other features to annotate your document.

- Select the date feature to insert a specific date into your paper.

- Include text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to develop fillable {fields.

- Click Sign from the top toolbar to create and establish your legally-binding signature.

- Press DONE to save, print, distribute, or download the final {file.

Related links form

When discussing payment terms, 'DoR' can refer to the Department of Revenue, which provides guidelines for tax payments and compliance. Understanding the payment terms set forth by the MA DoR is essential for maintaining good standing with the agency. For detailed information on compliance and obligations, consider using USLegalForms as a resource for clarity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.