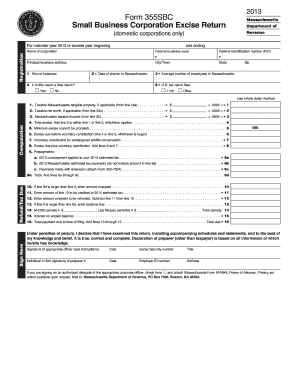

Get Ma Dor 355sbc 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MA DoR 355SBC online

How to fill out and sign MA DoR 355SBC online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your income and submitting all essential tax documents, including MA DoR 355SBC, is solely the duty of a US citizen. US Legal Forms simplifies your tax management making it more accessible and accurate. You can access any legal forms you need and complete them electronically.

How to complete MA DoR 355SBC online:

Keep your MA DoR 355SBC safe. Ensure that all your relevant documents and information are in the correct place while considering the deadlines and tax laws established by the Internal Revenue Service. Make it easier with US Legal Forms!

- Obtain MA DoR 355SBC in your browser from your device.

- Access the editable PDF document with a click.

- Start filling out the online template field by field, utilizing the guidance of the smart PDF editor’s interface.

- Accurately enter text and figures.

- Click the Date box to automatically populate the current date or adjust it manually.

- Use Signature Wizard to create your custom e-signature and validate in minutes.

- Refer to the IRS guidelines if you still have questions.

- Click Done to store your modifications.

- Continue to print the document, download it, or share it through Email, SMS, Fax, or USPS without leaving your browser.

How to Modify Get MA DoR 355SBC 2013: Personalize Forms Online

Your swiftly adjustable and adaptable Get MA DoR 355SBC 2013 template is readily accessible. Utilize our collection with an integrated online editor.

Do you hesitate to prepare Get MA DoR 355SBC 2013 because you simply can't figure out where to start or how to proceed? We empathize with your situation and provide an outstanding solution for you that does not involve battling your delays!

Our online selection of ready-to-modify templates allows you to sift through and choose from thousands of fillable documents designed for various purposes and situations. However, acquiring the document is just the beginning. We equip you with all the essential tools to complete, authorize, and modify the document of your preference without leaving our site.

All you need to do is access the document in the editor. Review the wording of Get MA DoR 355SBC 2013 and confirm whether it's what you desire. Start filling in the template utilizing the annotation tools to give your document a more organized and tidy appearance.

In summary, along with Get MA DoR 355SBC 2013, you'll receive:

With our professional solution, your finalized documents are always legally binding and thoroughly encrypted. We promise to safeguard your most sensitive information and details.

Acquire what is essential to create a professional-looking Get MA DoR 355SBC 2013. Make the optimal choice and test our platform today!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, redact, and modify the existing text.

- If the document is meant for others as well, you can include fillable fields and distribute them for others to complete.

- Once you finish filling in the template, you can download the file in any available format or choose any sharing or delivery methods.

- An efficient set of editing and annotation tools.

- A built-in legally-binding eSignature feature.

- The option to create documents from scratch or based on the pre-uploaded template.

- Compatibility with diverse platforms and devices for enhanced convenience.

- Multiple options for securing your files.

- A wide array of delivery methods for simpler sharing and distributing of files.

- Adherence to eSignature regulations governing the use of eSignature in online transactions.

Get form

Related links form

You can pick up Massachusetts tax forms at your local municipal government office or from the Massachusetts Department of Revenue. Furthermore, some public libraries may have these forms available for local residents. The MA DoR 355SBC can also be easily downloaded from the Department of Revenue’s official website.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.