Loading

Get Ma Dor 1099-hc 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR 1099-HC online

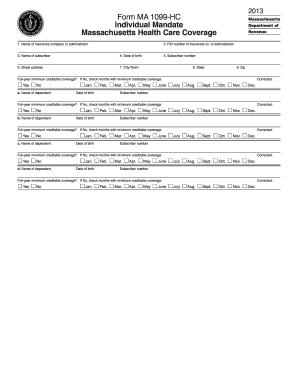

The MA DoR 1099-HC form is essential for individuals in Massachusetts to confirm their health care coverage. This guide provides clear and detailed instructions on how to complete the form accurately online.

Follow the steps to fill out your MA DoR 1099-HC form online.

- Press the ‘Get Form’ button to access the MA DoR 1099-HC form in your preferred online editor.

- Begin by entering the name of your insurance company or the administrator in the designated field at the top of the form.

- Next, input the Federal Identification Number (FID) of your insurance company or administrator in the next available space.

- Enter the name of the subscriber, which is the person whose health insurance coverage is being reported.

- Fill in the subscriber's date of birth to verify their identity.

- Complete the subscriber's street address to ensure accurate information for correspondence.

- Input the subscriber number assigned by the insurance company in the specified field.

- Specify the city or town where the subscriber resides in the relevant section.

- Provide the state and zip code in their respective fields to complete the address section.

- Indicate if the subscriber had full-year minimum creditable coverage by checking 'Yes' or 'No.' If 'No,' specify the months that had minimum creditable coverage by checking the corresponding boxes.

- If there are dependents, fill out the provided sections for each dependent's name, date of birth, and their respective months of minimum creditable coverage.

- Review all the filled information for accuracy and completeness to ensure compliance.

- Once completed, you can save your changes, download, print, or share the form as required.

Fill out your MA DoR 1099-HC form online today for accurate health care reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Typically, you need to file certain 1099 forms with the state if they reflect taxable income. For Massachusetts residents, the MA DoR 1099-HC must be filed to verify health insurance coverage. This documentation helps support your tax return and adherence to health requirements. Consider using US Legal Forms to simplify your filing experience and ensure you have everything in order.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.