Loading

Get Ldr R-540ins 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LDR R-540INS online

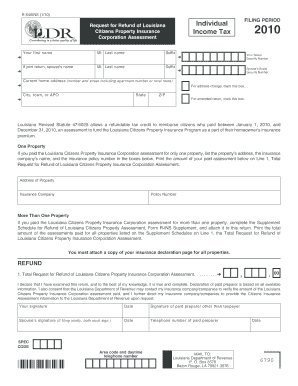

The LDR R-540INS form is essential for individuals seeking a refund of the Louisiana Citizens Property Insurance Corporation assessment paid during the 2010 calendar year. This guide will assist you in completing the form accurately and efficiently, ensuring a smooth application process.

Follow the steps to fill out the LDR R-540INS online with ease.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Fill in your first name, middle initial, and last name in the designated fields.

- Indicate your filing period and specify if it is an individual income tax request.

- If filing jointly, provide your spouse’s name, middle initial, and last name.

- Enter your Social Security number and, if applicable, your spouse’s Social Security number.

- Provide your current home address, ensuring to include any apartment number or rural route details.

- Mark the box for an address change if applicable and fill in your city, state, and ZIP code.

- If applicable, indicate that you are filing an amended return by marking the respective box.

- If you paid the assessment for one property, list the property’s address, the insurance company’s name, and the insurance policy number in the provided fields.

- Print the total amount of the assessment paid on Line 1, designated for the Total Request for Refund of Louisiana Citizens Property Insurance Corporation Assessment.

- If more than one property incurred an assessment, complete the R-INS Supplement form and attach it to your submission.

- Ensure all assessments paid for multiple properties are totaled, and that amount is printed on Line 1.

- Sign and date the form, and ensure that your spouse also signs if filing jointly.

- If a paid preparer completed the form, their signature and date should be included, along with their contact number.

- Finally, mail the completed form to the Louisiana Department of Revenue, P.O. Box 3576, Baton Rouge, LA 70821-3576.

Complete your documents online today for a streamlined filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To get a tax-exempt number for your farm, you must fill out the appropriate forms detailing your farming operations and how you meet certain criteria. The LDR R-540INS form is essential in this context, as it documents your request for tax exemption. Engaging with a tax professional can facilitate this process and ensure you meet all requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.