Loading

Get Ldr R-540ins 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LDR R-540INS online

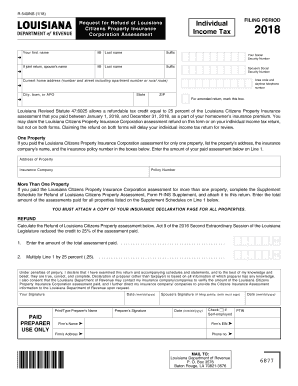

The LDR R-540INS form is designed for individuals seeking a refund of the Louisiana Citizens Property Insurance Corporation assessment paid during 2018. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the LDR R-540INS form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your first name, middle initial, last name, and suffix as applicable in the designated fields.

- If filing jointly, input your spouse’s first name, middle initial, last name, and suffix in the appropriate fields.

- Provide your Social Security Number and your spouse’s Social Security Number, ensuring accuracy.

- Include your area code and daytime telephone number in the specified section.

- Fill in your current home address, including the number, street, apartment number (if applicable), city or town, state, and ZIP code.

- Indicate if you are filing an amended return by marking the appropriate box.

- If you are claiming the refund for only one property, input the property address, the name of the insurance company, and the insurance policy number.

- For multiple properties, complete the Supplement Schedule for Refund of Louisiana Citizens Assessment and attach it to your return.

- Calculate your refund by entering the total amount of the assessments paid, multiplying that amount by 25% and entering the result.

- Sign and date the form, and ensure you have printed your name if a preparer is involved.

- Review your form for completeness, then save changes, download, and print your completed LDR R-540INS form for submission.

Complete your LDR R-540INS form online to ensure prompt processing and avoid delays.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The standard deduction for Louisiana varies based on your filing status, and it is subject to annual adjustments. Couples filing jointly and individuals may notice different amounts. When you file with LDR R-540INS, you will find it easy to select the correct deduction amount applicable to your situation, optimizing your tax return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.