Loading

Get La Ldr R-1201 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA LDR R-1201 online

Filling out the LA LDR R-1201 form online is a straightforward process. This guide will provide you with clear instructions on each section of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to complete the LA LDR R-1201 online.

- Press the 'Get Form' button to obtain the form and access it in the editor.

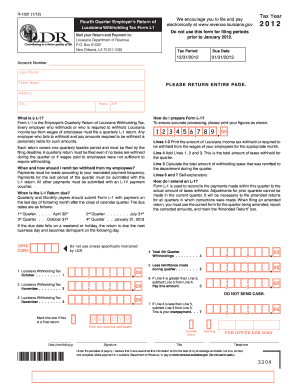

- Begin by entering the tax year in the designated field. Make sure to indicate '2012' as the tax year for this filing.

- Specify the tax period by selecting 'Fourth Quarter' for the applicable timeframe.

- Fill in the due date, ensuring it reflects '01/31/2013' as the submission deadline.

- Provide your account number as well as the legal name and trade name of your business.

- Input your business address, including city, state, and ZIP code accurately.

- For lines 1 to 3, print the amount of Louisiana income tax withheld as required for October, November, and December.

- On line 4, add lines 1, 2, and 3 to calculate the total amount of taxes withheld for the quarter.

- Calculate the total amount of withholding taxes submitted to the department in line 5.

- Follow the instructions for lines 6 and 7, which will determine your payment amount or overpayment.

- If applicable, mark the 'Amended Return' box if you are submitting changes to a previous return.

- Review all entered information for accuracy and completeness before finalizing.

- After verifying your entries, select the option to save your changes, and choose to download, print, or share the form as needed.

Complete and file your LA LDR R-1201 online today to ensure compliance and avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Hard copies of tax forms are available at local Louisiana Department of Revenue offices and select public libraries. Additionally, some community centers and post offices may offer an assortment of forms. However, for the most thorough options, visiting the Department of Revenue website will allow you to print or order the necessary forms directly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.