Loading

Get La Ldr R-1201 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA LDR R-1201 online

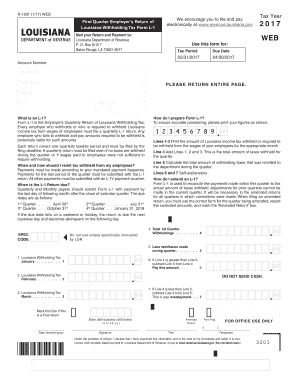

Filling out the LA LDR R-1201 form, which is the Employer’s Quarterly Return of Louisiana Withholding Tax, can be straightforward with the right guidance. This comprehensive guide will assist users in completing the form accurately and efficiently, ensuring compliance with Louisiana's tax regulations.

Follow the steps to complete the LA LDR R-1201 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Fill in the 'Tax Period' and 'Tax Year' fields, selecting the appropriate options for your submission.

- Enter the 'Due Date' for the form submission. Make sure to check for the correct due date based on the quarter you are filing for.

- Provide your 'Account Number', 'Legal Name', and 'Trade Name'. Ensure that all names are accurate as they will appear in official records.

- Complete the 'Address', 'City', 'State', and 'ZIP' fields. This information should match your business records.

- Proceed to Lines 1-3 to print the amounts of Louisiana income tax withheld for each month of the quarter.

- On Line 4, add the amounts from Lines 1, 2, and 3 to calculate the total amount of taxes withheld for the quarter.

- Enter the total amount of withholding taxes that were remitted to the department during the quarter on Line 5.

- Lines 6 and 7 will automatically calculate if there is a balance to pay or an overpayment situation.

- If applicable, tick the box for 'Amended Return' and provide the necessary corrections when adjustments are being made.

- Review all entries for accuracy before finalizing the form. Ensure you sign and date the form where indicated.

- Once you have completed the form, save your changes. You can then download, print, or share the completed document as needed.

Get started on filing your LA LDR R-1201 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The best withholding percentage depends on your financial situation and tax obligations. A commonly recommended starting point is around 15%, but adjusting based on your specific circumstances can lead to better outcomes. Additionally, consult the LA LDR R-1201 for guidelines that might help you optimize your withholding percentage.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.