Get La Ldr R-1201 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA LDR R-1201 online

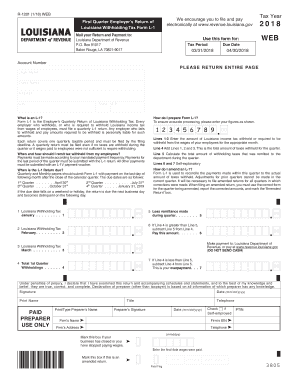

This guide provides comprehensive instructions for filling out the LA LDR R-1201 form online. By following the steps outlined below, users can ensure accurate completion of the form, facilitating proper submission and compliance with Louisiana's tax requirements.

Follow the steps to complete the LA LDR R-1201 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the tax period and tax year for which you are filing. Ensure this information is accurate as it affects your filing.

- Input your account number in the designated field. This number is unique to your business and is essential for processing your return.

- Enter your legal name as registered, followed by your trade name if applicable. This identifies your business accurately.

- Fill in your business address, including city, state, and ZIP code, to ensure you receive any correspondence regarding your filing.

- Proceed to Lines 1-3 where you will record the amounts of Louisiana income tax withheld for each of the three months in the quarter.

- On Line 4, sum the amounts entered in Lines 1, 2, and 3 to get your total withholding for the quarter.

- Calculate the total amount you have remitted to the department during the quarter and enter this amount on Line 5.

- If Line 4 is greater than Line 5, complete Line 6 by subtracting Line 5 from Line 4 to determine the amount due for payment.

- Conversely, if Line 5 is greater than Line 4, complete Line 7 by subtracting Line 4 from Line 5 to identify any overpayment.

- Review all entered information for accuracy before finalizing the form. Then, save your changes, and choose to download, print, or share the completed form as needed.

Complete your LA LDR R-1201 form online today to ensure timely submission and compliance with Louisiana tax regulations.

Get form

Related links form

Generally, a common benchmark for withholding ranges from 10% to 22% of your paycheck, depending on your tax bracket and personal circumstances. For accurate calculation, consider credits, deductions, and applicable state laws such as those outlined in LA LDR R-1201. Assessing your situation periodically throughout the year can help ensure that the amount withheld aligns with your overall tax obligations. Resources like uslegalforms can also offer valuable tools for determining your needs.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.