Loading

Get La Ldr It-540b 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA LDR IT-540B online

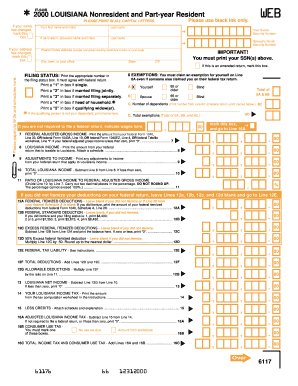

Filing your Louisiana Nonresident and Part-Year Resident Income Tax Return (LA LDR IT-540B) online can streamline the process and ensure accuracy. This guide provides step-by-step instructions to help you complete the form with confidence.

Follow the steps to successfully complete your tax form online.

- Click ‘Get Form’ button to access the LA LDR IT-540B. This will open the form in your preferred editor.

- Begin filling out your personal information in the designated fields. Include your first name, middle initial, last name, Social Security number, and current home address.

- If applicable, provide your spouse's information, including their name and Social Security number. Ensure to mark the appropriate boxes if names or addresses have changed.

- Indicate your filing status by printing the correct number in the filing status box. This must correspond with your federal tax return.

- Claim exemptions for yourself and your spouse if applicable, indicating if anyone is aged 65 or older or blind.

- Report the total number of dependents and their names as listed on your federal tax return.

- Input your federal adjusted gross income from the correct line of your federal Form 1040, Form 1040A, Form 1040EZ, or Telefile worksheet.

- Report your Louisiana income, including any adjustments, and calculate your total Louisiana income by following the provided lines.

- Fill in applicable deductions and tax amounts by following the instructions for federal itemized deductions and standard deductions.

- Calculate your total income tax and any applicable consumer use tax by adding the relevant lines.

- If you are due a refund or need to submit a payment, fill out the appropriate sections at the end of the form detailing your choice.

- Lastly, ensure to sign and date the form, indicating whether this is your first time filing and providing any preparer's information if applicable.

- Once complete, save your form, download or print it as needed, and prepare to submit it as instructed.

Start completing your LA LDR IT-540B online today for a more efficient tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The choice between filing a 540 or 540NR depends on your residency status. If you are a resident, you typically file a 540; if you are a non-resident, the 540NR is appropriate. Knowing the correct form is essential for accurate reporting and tax obligations. To avoid confusion, you may want to use resources such as US Legal Forms or the LA LDR IT-540B to guide your decisions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.