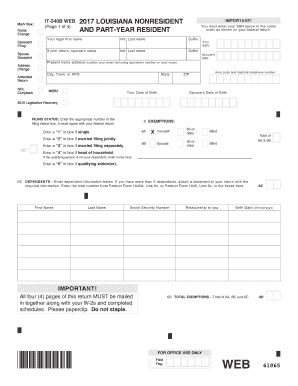

Get La Ldr It-540b 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign LA LDR IT-540B online

How to fill out and sign LA LDR IT-540B online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Recording your earnings and submitting all essential tax documentation, including LA LDR IT-540B, is an American citizen's sole responsibility. US Legal Forms simplifies your tax management to be more clear-cut and effective. You can obtain any legal documents you require and fill them out digitally.

How to complete LA LDR IT-540B online:

Safeguard your LA LDR IT-540B. Ensure that all your relevant documents and information are organized while keeping in mind the deadlines and tax regulations established by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Obtain LA LDR IT-540B on your browser from any device.

- Access the editable PDF file with a click.

- Start filling out the online template field by field, adhering to the guidance of the cutting-edge PDF editor's interface.

- Carefully input text and numbers.

- Click the Date field to automatically place the current date or modify it manually.

- Utilize Signature Wizard to create your personalized e-signature and sign in a matter of minutes.

- Consult IRS guidelines if you still have questions.

- Hit Done to save your changes.

- Continue to print the document, download, or send it via Email, text, Fax, USPS without leaving your browser.

How to adjust Get LA LDR IT-540B 2017: personalize forms online

Eliminate the clutter from your documentation process. Uncover the most efficient way to locate, alter, and submit a Get LA LDR IT-540B 2017.

The procedure of completing Get LA LDR IT-540B 2017 requires accuracy and focus, particularly for individuals who are not well-acquainted with this kind of task. It’s crucial to obtain an appropriate template and populate it with the accurate details. With the right solution for managing documents, you can access all the tools at your disposal. It's easy to simplify your editing workflow without acquiring new skills.

Find the correct model of Get LA LDR IT-540B 2017 and fill it out promptly without needing to navigate between browser tabs. Explore additional tools to personalize your Get LA LDR IT-540B 2017 form in the editing mode.

While on the Get LA LDR IT-540B 2017 page, click on the Get form button to initiate modifications. Enter your information into the form instantly, as all the essential tools are conveniently available here. The template is pre-structured, minimizing the effort required from the user. Simply utilize the interactive fillable fields in the editor to effortlessly finalize your documentation. Click on the form and move to the editor mode right away. Complete the interactive field, and your document is ready.

A minor mistake can spoil the entire form when filled out by hand. Eliminate inaccuracies in your documentation. Quickly find the templates you need and complete them electronically using an intelligent editing solution.

- Insert additional textual content around the document as necessary. Use the Text and Text Box tools to add text in a separate box.

- Incorporate pre-designed graphic elements like Circle, Cross, and Check using the respective tools.

- If required, capture or upload images to the document with the Image tool.

- Use Line, Arrow, and Draw tools if you need to sketch something in the document.

- Utilize the Highlight, Erase, and Blackout tools to modify the text in the document.

- If you wish to append comments to specific sections of the document, click on the Sticky tool and place your note accordingly.

Get form

Related links form

Louisiana offers a variety of tax breaks for seniors, including a special exemption amount for individuals aged 65 or older. This can lead to substantial savings on state income taxes for eligible seniors. When filing your return using the LA LDR IT-540B, you will want to apply any applicable exemptions to maximize your benefits. For more tailored information, uslegalforms offers resources and assistance focused on senior tax breaks.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.