Get La Ldr Cift-620ext-v 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA LDR CIFT-620EXT-V online

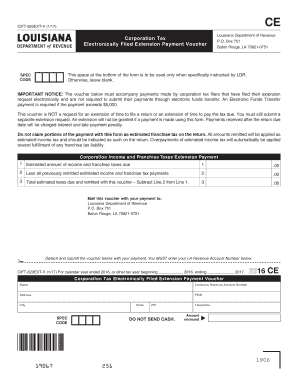

Filling out the LA LDR CIFT-620EXT-V form is an essential task for corporation tax filers in Louisiana who wish to make an extension payment for their taxes. This guide will provide clear instructions to help you navigate the process effortlessly.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your corporation’s name in the designated field at the top of the form. This should match your registered business name.

- Next, input your Louisiana Revenue Account Number below the name field. This number identifies your corporation in the Louisiana Department of Revenue system.

- Provide the complete address of your corporation including street address, city, state, and ZIP code. Ensure that this information is accurate to avoid any complications.

- Enter your Federal Employer Identification Number (FEIN) in the specified field. This number is crucial for tax identification.

- Fill in the estimated amount of income and franchise taxes due in the appropriate section. This is the total tax amount before considering previous payments.

- In the next field, specify any previously remitted estimated income and franchise tax payments. This allows for a correct calculation of your total taxes due.

- Calculate the total estimated taxes due by subtracting the previous payments from the total taxes due. Write this amount in the appropriate field.

- Finally, review all information for accuracy, ensuring that all fields are filled correctly. Once finalized, save your changes or print the form to include with your payment to the Louisiana Department of Revenue.

Complete your LA LDR CIFT-620EXT-V form online to ensure you meet your corporation's tax obligations promptly.

Get form

Related links form

To calculate Louisiana franchise tax, you start with the total equity of your company, then apply the tax rate according to the latest guidelines. Generally, the minimum tax begins at $300, but this can increase depending on your business's capital structure. The franchise tax is assessed based on the total amount of capital employed within the state. Accurate calculations are important to ensure compliance, and resources like the LA LDR CIFT-620EXT-V form can help guide you through the process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.