Get La It-540 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign LA IT-540 online

How to fill out and sign LA IT-540 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Documenting your income and submitting all the essential tax paperwork, including LA IT-540, is the sole responsibility of a US citizen. US Legal Forms enhances your tax administration to be more clear and effective. You can acquire any legal documents you need and complete them electronically.

How to prepare LA IT-540 online:

Keep your LA IT-540 safe. You must ensure that all your relevant documentation and information are in order while keeping in mind the deadlines and tax rules set by the IRS. Simplify the process with US Legal Forms!

- Obtain LA IT-540 in your web browser from your device.

- Access the editable PDF file with a click.

- Start filling out the form field by field, following the instructions of the sophisticated PDF editor's layout.

- Accurately enter text and figures.

- Click the Date field to automatically insert today's date or manually change it.

- Use the Signature Wizard to create your custom e-signature and sign in a matter of moments.

- Consult the IRS guidelines if you still have any inquiries.

- Press Done to save the changes.

- Proceed to print the document, download it, or send it via E-mail, SMS, Fax, USPS without leaving your browser.

How to modify Get LA IT-540 2016: personalize forms online

Experience a stress-free and paperless approach to handling Get LA IT-540 2016. Leverage our reliable online platform and save a significant amount of time.

Creating each form, including Get LA IT-540 2016, from the ground up consumes excessive time, so having a proven solution with preformatted document templates can improve your productivity remarkably.

However, utilizing them can be challenging, particularly with documents in PDF format. Fortunately, our vast library includes an integrated editor that enables you to swiftly fill out and tailor Get LA IT-540 2016 without leaving our site, ensuring that you don’t waste time filling out your forms. Here’s how to manage your form using our resources:

Whether you need to fill out editable Get LA IT-540 2016 or any other form present in our collection, you’re on the correct path with our online document editor. It's straightforward and secure and doesn’t necessitate special expertise. Our web-based tool is designed to manage nearly all aspects concerning document editing and completion.

Move away from traditional methods of managing your forms. Opt for a professional solution to streamline your tasks and reduce reliance on paper.

- Step 1. Find the necessary document on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize our expert editing tools that allow you to insert, delete, annotate, and emphasize or obscure text.

- Step 4. Generate and attach a legally-binding signature to your form by selecting the sign option from the upper toolbar.

- Step 5. If the form layout doesn’t appear as you wish, use the options on the right to eliminate, position, and rearrange pages.

- Step 6. Add fillable fields so other individuals can be invited to finish the form (if needed).

- Step 7. Distribute or send the form, print it out, or choose the format in which you prefer to receive the file.

Get form

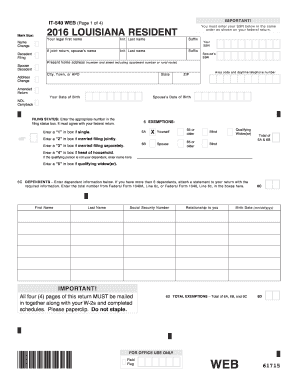

Tax form 540 is primarily used by Louisiana residents to report their income and calculate state income tax liability. This form encompasses various aspects, including income from different sources and applicable deductions or credits. For a thorough understanding of the form's requirements and connections to the LA IT-540, leveraging services from USLegalForms can be beneficial.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.