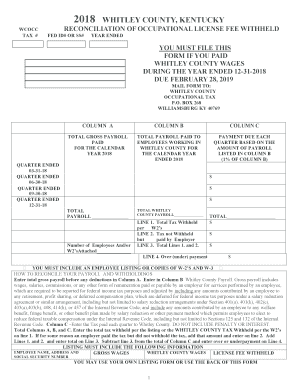

Get Ky Reconciliation Of Occupational License Fee Withheld - Whitley County 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign KY Reconciliation of Occupational License Fee Withheld - Whitley County online

How to fill out and sign KY Reconciliation of Occupational License Fee Withheld - Whitley County online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

It is the sole duty of a US citizen to report their income and submit all necessary taxation documents, including the KY Reconciliation of Occupational License Fee Withheld - Whitley County. US Legal Forms facilitates more accessible and accurate tax management.

Here’s how to prepare the KY Reconciliation of Occupational License Fee Withheld - Whitley County online:

Keep your KY Reconciliation of Occupational License Fee Withheld - Whitley County safe. You must ensure that all your correct documents and information are accurate while considering the deadlines and tax policies set by the IRS. Simplify the process with US Legal Forms!

- Obtain the KY Reconciliation of Occupational License Fee Withheld - Whitley County on your device through your web browser.

- Click to access the fillable PDF document.

- Begin completing the online template step by step, following the instructions of the advanced PDF editor’s user interface.

- Accurately input your text and numbers.

- Click on the Date field to automatically set the current date or adjust it manually.

- Utilize the Signature Wizard to create your personalized e-signature for quick signing.

- Refer to the Internal Revenue Service guidelines if you have any remaining questions.

- Select Done to save your changes.

- You can then print out the document, save it, or send it via Email, text message, Fax, or USPS without leaving your web browser.

How to Modify Get KY Reconciliation of Occupational License Fee Withheld - Whitley County 2018: Personalize forms online

Eliminate the clutter from your documentation process. Uncover the easiest method to locate, modify, and submit a Get KY Reconciliation of Occupational License Fee Withheld - Whitley County 2018.

The task of preparing Get KY Reconciliation of Occupational License Fee Withheld - Whitley County 2018 requires accuracy and attention, particularly from those who are not well-versed in this type of work. It is crucial to obtain an appropriate template and complete it with the accurate information. With the right solution for managing paperwork, you can access all the necessary tools. It is straightforward to simplify your modification process without acquiring new abilities.

Find the correct template of Get KY Reconciliation of Occupational License Fee Withheld - Whitley County 2018 and fill it out instantly without switching between tabs in your browser. Explore additional resources to personalize your Get KY Reconciliation of Occupational License Fee Withheld - Whitley County 2018 form in the modification mode.

While on the Get KY Reconciliation of Occupational License Fee Withheld - Whitley County 2018 page, simply click the Get form button to initiate edits. Enter your information directly into the form, as all the necessary tools are readily available. The template is pre-prepared, so the user's effort is minimal. Utilize the interactive fillable fields in the editor to effortlessly complete your documents. Just click the form and move to the editor mode immediately. Complete the interactive field, and your document is ready to go.

Occasionally, a minor mistake can spoil the entire form when filled out by hand. Eliminate inaccuracies in your documentation. Locate the templates you require in moments and complete them digitally via an intelligent editing solution.

- Surround the document with additional text if necessary. Utilize the Text and Text Box tools to add text in a separate box.

- Incorporate pre-designed graphical elements like Circle, Cross, and Check using their respective tools.

- If required, capture or upload images to the document with the Image tool.

- If you need to sketch something in the document, make use of Line, Arrow, and Draw tools.

- Experiment with the Highlight, Erase, and Blackout tools to alter the text in the document.

- If you wish to add remarks to particular sections of the document, click the Sticky tool and position a note where desired.

Get form

Related links form

Claiming Allowances on Your W-4 You can claim allowances on this W-4 form. On your income tax return, you generally claim an exemption for yourself and your spouse, as well as any dependents that you have. ... The IRS will send notification to your employer if you are only allowed to claim a certain number of allowances.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.