Loading

Get Ky Form Ol-3d 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY Form OL-3D online

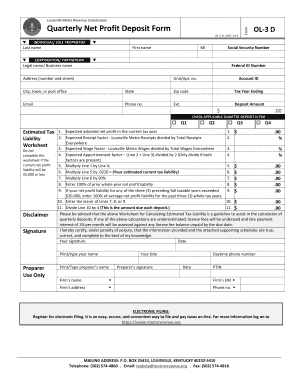

Filling out the KY Form OL-3D is an essential step for individuals and businesses to report their quarterly net profit deposits. This guide provides clear and supportive instructions on how to complete the form online.

Follow the steps to successfully complete the KY Form OL-3D online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Identify your entity type at the top of the form. Select either 'Individual/Sole Proprietor' or 'Corporation/Partnership' by checking the appropriate box.

- Input your personal details in the fields provided. Fill in your last name, first name, federal ID number, complete address including unit/apt number, city or town, state, zip code, email address, phone number, and extension if applicable.

- Specifically indicate the tax year ending. This is crucial for accurate reporting.

- Check the applicable quarter deposit for which you are filing: Q1, Q2, Q3, or Q4. Ensure you only check one box.

- Complete the estimated tax section. Start by entering your expected adjusted net profit for the current tax year in the designated field.

- Calculate the expected receipt factor and enter that value. This is determined by dividing Louisville Metro Receipts by Total Receipts.

- Next, calculate the expected wage factor, which is done by dividing Louisville Metro Wages by Total Wages Everywhere. Enter this percentage.

- Following that, determine the expected apportionment factor by averaging the previous two factors if both are present.

- Continue by multiplying your estimated adjusted net profit by the apportionment factor to determine the estimated current tax liability.

- Calculate 90% of your estimated current tax liability and enter that value.

- Input 100% of your prior whole year net profit liability in the respective field.

- If your net profit liability from the previous three full taxable years exceeded $20,000, enter 100% of the average net profit liability for those years.

- Lastly, find the lesser amount among the previous calculations and divide it by 4 to determine the amount due for each deposit.

- Review all entries for accuracy before finishing the form. You may then save your changes, download, print, or share the completed form.

Complete your KY Form OL-3D online to ensure accurate reporting and timely deposits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A Kentucky nonresident reciprocal state form is designed for individuals who live in another state but earn income in Kentucky. This form allows them to navigate tax affects effectively when filing their returns. If you're a non-resident taxpayer, being aware of forms like KY Form OL-3D can help clarify your tax responsibilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.