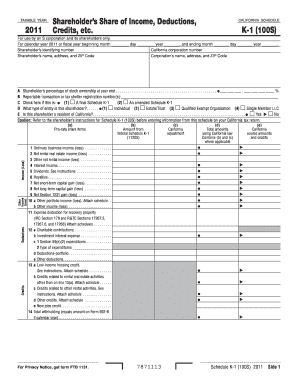

Get Ca Ftb 100s Schedule K-1 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CA FTB 100S Schedule K-1 online

How to fill out and sign CA FTB 100S Schedule K-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the taxation period commenced unexpectedly or you simply overlooked it, it may likely create challenges for you.

CA FTB 100S Schedule K-1 is not the simplest form, but you shouldn't have any cause for concern under any circumstances.

With our comprehensive digital service and its supportive tools, filling out CA FTB 100S Schedule K-1 becomes more efficient. Feel free to utilize it and spend more time on hobbies rather than on paperwork.

- Launch the document using our specialized PDF editor.

- Complete all the required information in CA FTB 100S Schedule K-1, utilizing the fillable fields.

- Include images, checkmarks, and text boxes as desired.

- Repetitive information will be inserted automatically after the initial entry.

- In case of difficulties, utilize the Wizard Tool. You will receive helpful hints for smoother completion.

- Always remember to indicate the filing date.

- Create your unique digital signature once and place it in the necessary spots.

- Review the details you have provided. Rectify errors if needed.

- Click on Done to complete the editing process and select the method of submission. You have the option to use digital fax, USPS, or email.

- Additionally, you can download the document to print it later or upload it to cloud storage like Google Drive, Dropbox, etc.

How to Modify Get CA FTB 100S Schedule K-1 2011: personalize forms online

Your swiftly adjustable and customizable Get CA FTB 100S Schedule K-1 2011 template is at your fingertips. Utilize our collection with an integrated online editor.

Do you delay finishing Get CA FTB 100S Schedule K-1 2011 because you simply don’t know where to begin and how to progress? We empathize with your situation and have an excellent tool for you that has absolutely nothing to do with overcoming your stalling!

Our online selection of editable templates enables you to browse through and select from thousands of fillable forms designed for various purposes and situations. However, acquiring the document is just the beginning. We provide you all the essential features to fill out, certify, and modify the document of your preference without leaving our site.

All you need to do is to access the document in the editor. Review the wording of Get CA FTB 100S Schedule K-1 2011 and verify whether it aligns with your requirements. Start completing the template by utilizing the annotation tools to give your form a more structured and tidy appearance.

In summary, along with Get CA FTB 100S Schedule K-1 2011, you'll receive:

With our professional solution, your finalized forms will nearly always be legally binding and entirely encrypted. We ensure the protection of your most sensitive information.

Acquire all that is necessary to create a professional-looking Get CA FTB 100S Schedule K-1 2011. Make a wise decision and try our platform today!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, obscure, and amend the existing text.

- If the document is intended for additional users as well, you can incorporate fillable fields and distribute them for others to complete.

- Once you’ve completed the template, you can obtain the document in any available format or select any sharing or delivery options.

- A comprehensive set of editing and annotation functionalities.

- An integrated legally-binding eSignature solution.

- The ability to create forms from scratch or based on pre-prepared templates.

- Compatibility with various platforms and devices for enhanced convenience.

- Numerous options for safeguarding your documents.

- A variety of delivery choices for smoother sharing and dispatching of files.

- Adherence to eSignature regulations governing the utilization of eSignatures in electronic transactions.

Get form

Aggregate gross receipts for K-1 refers to the total income received by the S corporation before any deductions are applied. This figure is important for shareholders as it affects tax reporting and potential benefits claimed. Understanding where your aggregate gross receipts fit within the CA FTB 100S Schedule K-1 can help you budget and plan effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.