Get Ky Dor 725 (41a725) 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY DoR 725 (41A725) online

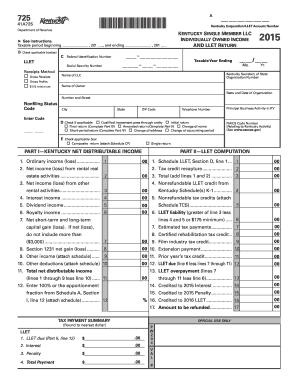

Filling out the KY DoR 725 (41A725) online is an essential process for individuals who own single member limited liability companies in Kentucky. This guide provides step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the KY DoR 725 (41A725) online

- To start, press the ‘Get Form’ button to access the KY DoR 725 (41A725) online and open it in your browser.

- Begin by entering the taxable period dates at the top of the form, indicating the beginning and end of the taxable period in the respective fields.

- In section B, check the applicable box(es) that pertain to your filings, such as whether you are using the receipts method for gross profits.

- Complete the fields for your federal identification number, social security number, and the name of your LLC.

- Provide your Kentucky Corporation/LLET Account Number and address details in the given fields, ensuring all information is accurate.

- Indicate if this represents your initial, final, amended return, or if there are any changes in status, addressing the applicable checkboxes.

- Fill in Part I, where you will provide information on ordinary income (loss) for the taxable year.

- In Part II, compute your LLET liability by entering the required data in the lines for net income, credits, and applicable deductions as instructed.

- Complete Part III to calculate any applicable LLET credits based on the previous sections.

- Review all fields for completeness and accuracy, then proceed to save your changes, and if needed, download, print, or share the form.

Complete your KY DoR 725 (41A725) online today for a hassle-free filing experience.

Get form

Related links form

Certain individuals and entities may qualify for exemption from Kentucky income tax, such as nonprofit organizations and specific trust funds. Additionally, if your income falls below a designated threshold, you might not need to file. Service providers like uslegalforms can assist you in understanding these exemptions and ensure you complete the necessary documentation like the KY DoR 725 (41A725) if required.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.