Loading

Get Sc Schedule Nr 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC Schedule NR online

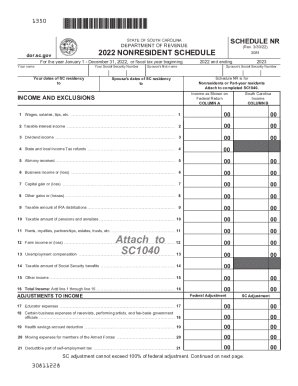

Completing the SC Schedule NR can seem daunting, particularly for users unfamiliar with tax forms. This guide offers a step-by-step approach to filling out the Schedule NR accurately and efficiently, ensuring you meet your tax obligations as a nonresident or part-year resident of South Carolina.

Follow the steps to successfully complete your SC Schedule NR online.

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Enter your name and Social Security number in the designated fields. Ensure your information is accurate to avoid processing delays.

- Fill in the dates of your South Carolina residency, including the start and end dates. This information is essential for determining your tax obligations.

- If applicable, provide your spouse's first name and Social Security number, along with their South Carolina residency dates.

- Move to the 'Income and Exclusions' section. For each type of income listed in Column A, enter the corresponding amounts in Column B indicating your South Carolina income. Be thorough with all income categories such as wages, interest, dividends, and other relevant sources.

- Calculate your total income by adding all amounts from lines 1 through 15 in Column B. Enter this total on line 16.

- Proceed to the 'Adjustments to Income' section. You may need to refer to the instructions to input any applicable federal adjustments. Ensure that any South Carolina adjustments do not exceed your federal adjustments.

- Continue filling in any South Carolina additions and subtractions, as indicated on lines 32 through 42. This calculation affects your overall tax liability.

- After successfully calculating your totals, complete lines 44 through 48 to determine your South Carolina taxable income.

- Review all entries for accuracy before finalizing the form. Upon completion, save your changes, and prepare to submit the form along with your SC1040 and a complete copy of your federal return.

Complete your SC Schedule NR online today to ensure a smooth and accurate tax filing process.

Veteran Property Taxes Veterans with a 100 percent service-connected disability are eligible for a total exemption of property tax on their homes as well as a homestead tax deduction of up to $50,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.