Loading

Get Sc Dor Sc1040 Instructions 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1040 Instructions online

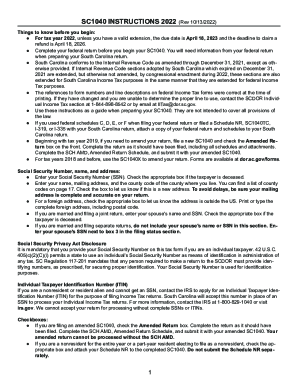

Filling out the SC DoR SC1040 form can seem daunting, but with clear guidance, you can complete it effortlessly online. This guide will provide you with step-by-step instructions to ensure you accurately fill out your South Carolina Individual Income Tax return.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to obtain the SC1040 form and open it for completion.

- Start by entering your Social Security Number in the designated field, and mark if the taxpayer is deceased, if applicable.

- Provide your full name, mailing address, and the appropriate county code corresponding to your residence. You can find the county codes in the provided list.

- Indicate if you are filing a joint return by entering your spouse's name and Social Security Number, ensuring you check the box if they are deceased.

- Select your filing status, ensuring you only check one box as applicable.

- Fill in the number of eligible dependents and provide their names, Social Security Numbers, relationships, and birthdates where required.

- Continue to enter your federal taxable income from your federal return and include all relevant additions or subtractions as detailed in the form instructions.

- Calculate any deductions, ensuring all data aligns with information from your federal return.

- Upon completing your form, review all entries for accuracy, ensuring you have attached any required schedules or documentation.

- Finally, save your changes, download, or print the completed form for submission as needed.

Begin filling out your SC DoR SC1040 form online today to ensure timely submission of your tax return.

South Carolina is very tax-friendly toward retirees When it comes to where you're going to retire, taxes are an important part of the equation. South Carolina's tax code is great for retirees; not only is Social Security not taxable, but there's a sizable deduction for other kinds of retirement income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.