Loading

Get Sc Dor Sc1040 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1040 online

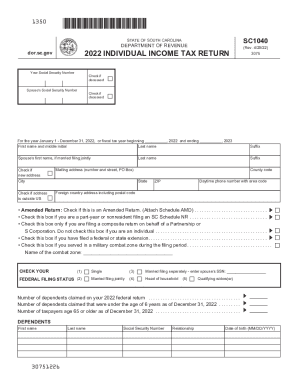

Filling out the SC DoR SC1040 form for your individual income tax return can seem daunting, but with this comprehensive guide, you will find clear instructions and helpful tips to navigate each section confidently. This document focuses on the online process so you can efficiently complete your tax return.

Follow the steps to complete your SC DoR SC1040 form online.

- Click ‘Get Form’ button to access the document. This will allow you to open the SC DoR SC1040 form in an editable format.

- Begin with entering your Social Security Number. Ensure that it is accurate to avoid any processing delays. If you are married, also provide your spouse's Social Security Number and indicate if either is deceased.

- Indicate the tax year for which you are filing, specifying whether it is for the calendar year or a fiscal year.

- Complete your personal information, including first name, last name, mailing address, city, state, and ZIP code. Be sure to check if you have a new address or if your mailing address is outside the United States.

- Select your federal filing status from options like single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- List the number of dependents claimed on your federal return, especially focusing on those under six years old as of December 31, 2022, and taxpayers aged 65 or older.

- Move to the income and adjustments section. Input your federal taxable income and any necessary additions or subtractions based on the provided categories. Ensure to follow instructions for any specific entries.

- Calculate your total South Carolina income subject to tax by subtracting line totals as prompted. Carefully check calculations to minimize errors.

- Proceed to enter any credits, deductions, payments, and tax due based on the indicated lines of the form. Always refer to the instructions for detailed guidance on each credit or payment.

- Review the completed form for accuracy. Users can typically save changes, download, print, or share the form based on the options provided in the online interface.

Complete your tax returns online today using this guidance for a smoother experience.

South Carolina is very tax-friendly toward retirees South Carolina's tax code is great for retirees; not only is Social Security not taxable, but there's a sizable deduction for other kinds of retirement income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.