Loading

Get Irs 1023-ez Instructions 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1023-EZ Instructions online

Filing for tax-exempt status can often feel overwhelming. This guide provides clear, step-by-step instructions on how to complete the IRS 1023-EZ instructions online, ensuring that even those with limited legal experience can navigate the process successfully.

Follow the steps to complete the IRS 1023-EZ Instructions online.

- Click the ‘Get Form’ button to download the IRS 1023-EZ form and open it in your preferred application for editing.

- Begin with the General Instructions section. This will provide you with critical information about eligibility and the purpose of the form.

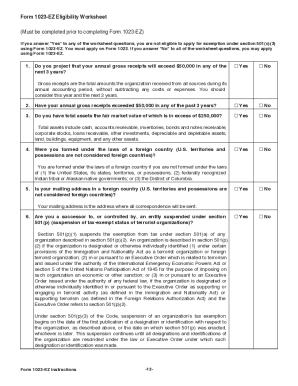

- Complete the IRS 1023-EZ Eligibility Worksheet to confirm your eligibility to file the form. Ensure you accurately answer all questions.

- Fill in Part I, Identification of Applicant. Include the full name, mailing address, and employer identification number (EIN) of your organization.

- In Part II, Organizational Structure, indicate your organizational type and include the organizing documents that support your application.

- Proceed to Part III, Your Specific Activities. Provide a brief but clear description of the organization’s primary mission or the activities it will conduct.

- In Part IV, Foundation Classification, check the box that corresponds to your foundation type based on your expected revenue and public support.

- In Part V, if applicable, address Reinstatement After Automatic Revocation, providing specific details depending on your previous exempt status.

- Finally, complete the Signature section in Part VI, ensuring it includes the authorized individual’s name, title, and the date of signing.

- Once all information is completed, review the form for accuracy, then proceed to save changes, download, print, or share the finalized form online.

Start the process of completing your IRS 1023-EZ Instructions online today!

Form 1023-EZ is used to apply for recognition as a tax-exempt organization under Section 501(c)(3). Applicants can learn more about the requirements, benefits, limitations and expectations of tax-exempt organizations by accessing the online courses at the IRS Small to Mid-Size Tax Exempt Organization Workshop.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.