Loading

Get Irs Instruction 1041 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1041 online

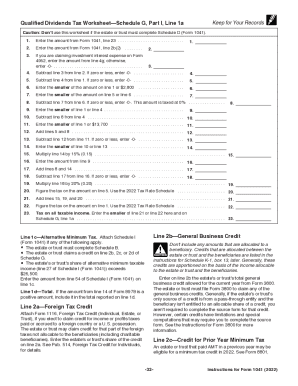

Filing the IRS Instruction 1041 can be a complex task for many users, especially for those who are not familiar with tax regulations. This guide offers clear, step-by-step instructions on how to accurately complete the form and what information you'll need.

Follow the steps to confidently complete your IRS Instruction 1041.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the estate or trust at the top of the form in the designated field.

- Document the fiduciary's name and title, ensuring that the details match previous filings to avoid discrepancies.

- Fill in the address associated with the estate or trust, including the city, state, and zip code.

- Indicate the type of entity in the section provided by checking the appropriate box or boxes.

- Specify the number of Schedules K-1 attached, if any, to ensure accurate reporting.

- Enter the Employer Identification Number (EIN) in the space provided, ensuring it is correct for tax purposes.

- Provide the date the entity was created, which is critical for tax and legal documentation.

- Complete the income and deduction sections, detailing all applicable figures as instructed.

- Review for any specific credits or other deductions that may apply and ensure these are accurately reflected.

- Finalize the document by checking all fields for accuracy and completeness to avoid delayed processing.

- Once complete, save your changes, download a copy for your records, and print the form for submission.

Complete your IRS Instruction 1041 online now to ensure timely and accurate filing.

Funeral expenses are not deductible on Form 1041; they are deductible only on Form 706. With respect to the other expenses, they would only be deductible, if at all, as administration expenses incurred for the management, conservation, or maintenance of estate/trust property and would be subject to the 2% floor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.