Loading

Get Ky Form Ol-3d 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY Form OL-3D online

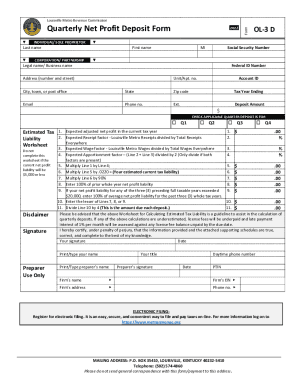

Filling out the KY Form OL-3D correctly is essential for ensuring compliance with local tax regulations. This guide will walk you through each section of the form, providing step-by-step instructions to navigate the online process effectively.

Follow the steps to complete KY Form OL-3D online.

- Press the ‘Get Form’ button to access the KY Form OL-3D and open it in your preferred digital environment.

- Begin filling out the form by selecting the appropriate category for your entity type: Individual/Sole Proprietor or Corporation/Partnership.

- Provide your last name, first name, and middle initial, if applicable, ensuring accuracy as this will be used for identification.

- Enter your Social Security Number or Federal ID Number as required based on your entity type.

- Fill in your complete legal name or business name to clearly identify your entity.

- Input your mailing address details, including the account ID, unit/apartment number, city, state, and zip code.

- Provide your email address and phone number for any communication regarding your submission.

- Indicate the tax year ending date for which you are filing this form.

- Check the applicable quarter for which you are making the deposit (Q1, Q2, Q3, or Q4) to ensure your calculations align with the correct reporting period.

- Fill out the worksheet for calculating your estimated tax liability by completing the necessary fields with the expected adjusted net profit and applicable factors.

- Sign and date the form to certify that all information is accurate and complete to your knowledge.

- Review the filled form for accuracy before finalizing your submission.

- Once completed, you can save changes to the form, download it for your records, print it, or share it as needed.

Complete your KY Form OL-3D online today to ensure timely and accurate tax compliance.

The Louisville Metro Revenue Commission, formerly known as the "Commissioners of the Sinking Fund", is a municipal corporation that was created in 1851 by act of the Kentucky General Assembly as the bond servicing agent for the City of Louisville's general obligation debt.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.