Loading

Get Irs 1040-v 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-V online

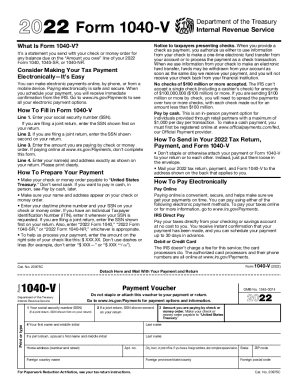

The IRS 1040-V form is a payment voucher that accompanies your tax return when you are submitting payment to the Internal Revenue Service. This guide will provide comprehensive instructions on how to complete this essential form online, ensuring a smooth filing process.

Follow the steps to complete your IRS 1040-V online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your social security number (SSN) in Line 1. If filing a joint return, provide the SSN for the first person listed.

- Once you have entered all needed information, review the form for any errors.

- You may save your changes, download the completed form, or print it for your records.

- Send your completed 2022 tax return, payment, and Form 1040-V in a loose envelope to the appropriate address listed on the back of the form.

Complete your forms online for a hassle-free filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The IRS has a 30-day grace period during which you can pay your missing payment. After this grace period, the IRS has the right to cancel the agreement, which means you have to pay the entirety of the remaining debt or face a wage garnishment, lien, levy, or some other collective action.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.