Loading

Get Tx Comptroller 05-158-a 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 05-158-A online

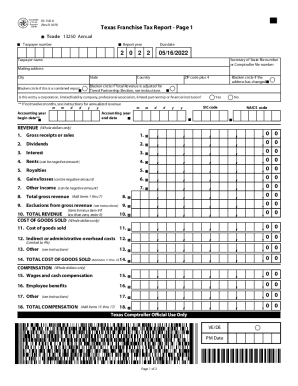

The TX Comptroller 05-158-A is a crucial form for reporting franchise taxes in Texas. This guide provides detailed, step-by-step instructions to assist users in accurately completing the form online, ensuring compliance and correctness.

Follow the steps to fill out the TX Comptroller 05-158-A

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxpayer number, report year, and due date. Ensure that the report year matches the tax period for which you are filing.

- Fill in the taxpayer name and the Secretary of State or Comptroller file number. This information is essential for proper identification.

- Provide the mailing address, city, state, country, and ZIP code plus four. Double-check these details for accuracy and completeness.

- If applicable, blacken the circle indicating whether this is a combined report or if the address has changed since the last filing.

- Specify the entity type by indicating whether it is a corporation, limited liability company, or other specified types.

- For revenue sections, enter the gross receipts or sales, dividends, interest, rents, royalties, gains/losses, and other income. Only whole dollar amounts are to be recorded.

- Calculate total gross revenue by adding items related to income from steps 7. Make sure to also include any exclusions from gross revenue.

- Proceed to fill out the cost of goods sold, entering data in items 11 through 14, ensuring to add as necessary to obtain the total.

- Complete the compensation section by reporting wages and cash compensation, employee benefits, and any other forms of compensation.

- Continue to the margins section and calculate the taxable margin based on the instructions provided.

- Finally, review all entries, save changes, and prepare to download, print, or share your completed form as required.

Complete your TX Comptroller 05-158-A form online to ensure timely and accurate filing.

To qualify as a passive entity, the entity must be a partnership or trust, other than a business trust, for the entire accounting period on which the tax is based. The entity may not qualify as passive for the accounting period during which the conversion occurs even if it meets the 90 percent income test.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.