Loading

Get Irs Instruction 4797 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 4797 online

Filling out the IRS Instruction 4797 form can seem daunting, but with a clear understanding of its sections and requirements, the process becomes manageable. This guide provides a step-by-step approach to help you complete the form accurately and efficiently.

Follow the steps to successfully fill out the form.

- Use the ‘Get Form’ button to access the IRS Instruction 4797 and open it in the designated editor.

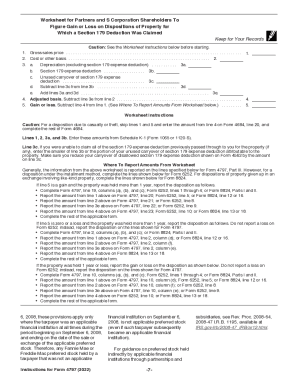

- Read through the general instructions provided at the beginning of the form. This section outlines the purpose of the form and details on what transactions must be reported.

- Begin completing Part I of the form, where you will need to report any Section 1231 transactions, such as sales of property used in a trade or business held for more than one year.

- If applicable, proceed to Part II to report ordinary gains and losses from property transactions that do not belong in Part I or III.

- Consult Part III for any depreciation recapture information. This section is crucial if you have previously claimed depreciation on the disposed property.

- Take care to fill in any relevant amounts on lines specified for the disposition of certain assets, ensuring you calculate any gains or losses precisely according to instructions.

- Upon completion, review your entries for accuracy and ensure all required information is included.

- Finally, save your changes, download the completed form, or print it for your records or submission.

Prepare and file your IRS Instruction 4797 form online today for a more efficient tax process.

You report all capital gains on the sale of real estate on Schedule D of IRS Form 1040, the annual tax return. ... A capital gain is the difference between the price you paid for the property and the amount you receive when you sell it and you can deduct most of your selling costs when calculating the profit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.