Loading

Get Ak Form 662 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 662 online

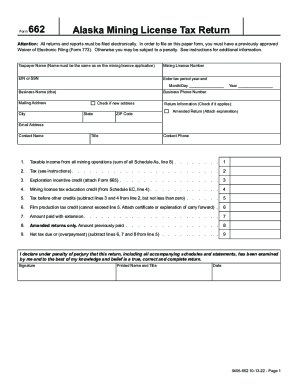

Filling out the AK Form 662 online requires careful attention to detail and understanding of the tax components specific to mining operations in Alaska. This guide will provide you with a clear, step-by-step process to navigate each section of the form effectively.

Follow the steps to complete your online Alaska mining license tax return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your taxpayer name, which must match the name on your mining license application. Ensure accuracy to avoid potential penalties.

- Input your mining license number. This unique identifier is critical for your tax return.

- Provide your EIN or SSN. This number is used for identification purposes and tax processing.

- Indicate the tax period year-end, which is important for aligning your income and deductions with the correct tax year.

- Enter your business name (dba) and a valid business phone number to ensure that the tax authorities can contact you if necessary.

- Enter your mailing address, including city, state, and ZIP code. If this is a new address, check the provided box.

- Fill out the email address and contact name fields so that the tax authorities can reach you digitally.

- In the return information section, check if you are filing an amended return. Attach any required explanations.

- Proceed to complete the taxable income section by summarizing the taxable income from all mining operations as detailed in Schedule A.

- Calculate the tax as described in the form instructions, ensuring to adhere to the applicable tax rates.

- If eligible, enter any exploration incentive credit amounts and the mining license tax education credit from Schedule EC.

- Subtract the credits from the tax amount to arrive at your tax before other credits. Ensure that this number is not less than zero.

- Complete the film production tax credit and payment details for any extensions.

- Finally, calculate the net tax due or overpayment, then review the entire form for accuracy.

- Once complete, save your changes and choose to download, print, or share the form as needed.

Complete your AK Form 662 online today to ensure timely filing and compliance.

Place Form W-2 or 1099 (or other tax backup forms received from your employer and other sources) on top of Form 1040. Paperclip or staple the entire return together. Mail the return to the address indicated by the IRS for your state by April 15th.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.