Loading

Get Ri Tx-16 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI TX-16 online

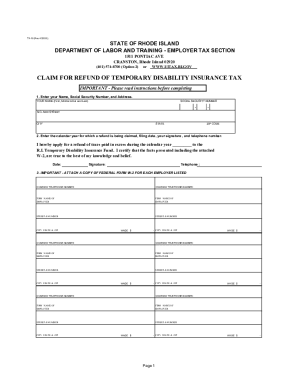

Filling out the RI TX-16 form online is a straightforward process that can help you claim a refund for overpaid temporary disability insurance taxes. This guide will walk you through each section of the form to ensure that you complete it accurately and efficiently.

Follow the steps to successfully fill out the RI TX-16 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In section 1, enter your full name, Social Security Number, and address. Ensure that the information is complete and accurately reflects your details.

- For section 2, indicate the calendar year for which you are claiming a refund, your signature, and your telephone number. Double-check the accuracy of these details.

- In section 3, list each employer for whom you worked during the calendar year. Enter the employer's firm name, address, telephone number, and the wages received. This section is critical and must only include employers registered in Rhode Island.

- Attach a copy of Form W-2 for each employer listed. Remember, each employer must have a different Federal Identification Number, and photocopies will not be accepted.

- Review the entire claim for refund form to ensure all information is correct and complete. Sign the form before submission.

- Once reviewed, save your changes and either print the form or share it as required. Make sure to send the completed form to the specified address for processing.

Start filling out your document online to claim your refund effortlessly.

In order to close your LLC, you will need to remit a Request for a Letter of Good Standing to the RI Division of Taxation. ... If you have a sales tax and/or withholding account, close your account by completing and filing a Final Return Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.