Loading

Get Ut Ustc Tc-721 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-721 online

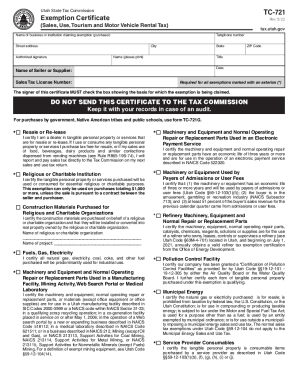

The UT USTC TC-721 form is designed for exempting certain tax responsibilities in Utah. This guide provides step-by-step instructions on how to complete this form online, ensuring clarity and ease of use for all individuals, regardless of their legal background.

Follow the steps to fill out the UT USTC TC-721 form online.

- Click the ‘Get Form’ button to obtain the UT USTC TC-721 form and open it in your preferred online editor.

- Begin by entering the name of your business or institution claiming the exemption in the first field. This information is essential for identifying the purchaser.

- Fill in the telephone number, street address, city, state, and ZIP code of your business or institution. Ensure that the details are accurate to avoid any processing issues.

- In the 'Name' section, print your name clearly as it will be required for validation purposes.

- Provide your title and the date of completion in the designated fields, ensuring they reflect your role within the entity claiming the exemption.

- Next, enter the name of the seller or supplier along with their sales tax license number in the appropriate sections to validate the transaction.

- Carefully check the box that corresponds to the basis for which the exemption is being claimed. It is crucial to ensure that the selected exemption is applicable to your specific purchase.

- After completing all required sections, review the form for accuracy. Make any necessary edits to ensure all information is correct.

- Once all fields are completed and verified, you can save changes, download, print, or share the form as needed.

Complete your UT USTC TC-721 form online today for a seamless tax exemption experience.

Sales & Use Tax The Business Tax and Fee Division and the Field Operations Division are responsible for administering California's state, local, and district sales and use tax programs, which provide more than 80 percent of CDTFA-collected revenues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.