Loading

Get Dc D-40b 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DC D-40B online

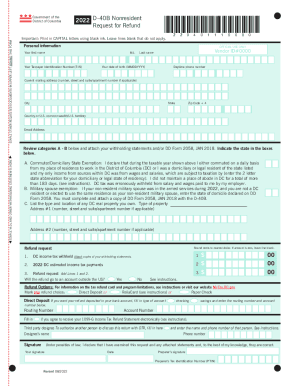

The DC D-40B form allows non-residents of the District of Columbia to request a refund of income tax that has been withheld. This guide will provide clear and comprehensive instructions to help you complete the form accurately and efficiently in an online format.

Follow the steps to successfully complete the DC D-40B online

- Press the ‘Get Form’ button to access the DC D-40B form and open it in your preferred form editing software.

- Fill out your personal information in capital letters using black ink. Complete fields for your first name, middle initial, last name, taxpayer identification number (TIN), date of birth, daytime phone number, current mailing address, city, state, zip code + 4, country, and email address.

- Staple W-2s and other withholding statements behind the form, ensuring they are clearly labeled and organized.

- For the commuter/domiciliary state exemption, declare your commuting status or residency. If applicable, provide the two-letter abbreviation of your domiciliary state and ensure you indicate that DC tax was erroneously withheld by your employer.

- If claiming the military spouse exemption, complete the necessary fields and attach DD Form 2058. Provide the state of domicile your military spouse declared.

- List any DC real property you own by filling in the type and location of the property. Specify two addresses if necessary.

- Detail your refund request by rounding cents to the nearest dollar. Enter the total for DC income tax withheld and estimated income tax payments in the respective fields, then sum these values.

- Indicate whether the refund will be deposited in an account outside the USA and select your preferred refund option: direct deposit, ReliaCard, or paper check. Fill in the appropriate routing and account numbers if opting for direct deposit.

- Provide information for a third-party designee if applicable, including their name, signature, and phone number.

- Sign and date the form to declare the information is correct. If someone else prepared the form, they must sign as well and provide their Preparers Tax Identification Number (PTIN).

- Once all fields are complete and checked for accuracy, save your changes, download, print, or share the completed form as needed.

Complete your DC D-40B online today and ensure your tax refund request is submitted efficiently.

Do I need to file both D.C and Maryland tax return if I live in Maryland while work in D.C.? No. ... DC and MD have a reciprocity agreement--an agreement between two states that allows residents of one state to request exemption from tax withholding in the other (reciprocal) state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.