Loading

Get Ar Ar3 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR AR3 online

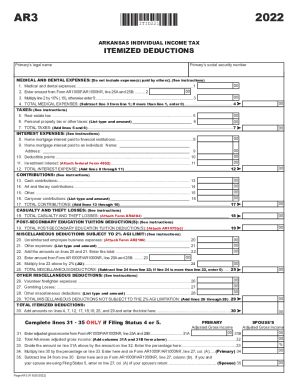

The AR AR3 form is essential for reporting itemized deductions in Arkansas, allowing individuals to potentially reduce their taxable income. This guide will provide you with clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to effectively complete your AR AR3 form.

- Click the ‘Get Form’ button to access the AR AR3 form, which you can then open in your preferred online editor.

- Begin by entering the primary individual’s legal name and social security number at the top of the form.

- Proceed to the 'Medical and Dental Expenses' section. Enter all applicable medical and dental expenses while ensuring you do not include any expenses paid by others. Calculate the total medical expenses by subtracting 10% of the amount from line 2 from line 1.

- In the 'Taxes' section, input real estate taxes and any personal property tax, including descriptions as necessary. Sum these amounts to determine the total taxes.

- Move to the 'Interest Expenses' section. List mortgage interest, deductible points, and any investment interest. Add them up to find the total interest expense.

- Fill out the 'Contributions' section with any cash or other qualifying contributions. Make sure to list all types provided in the form to arrive at total contributions.

- If applicable, document any casualty and theft losses in the designated section by attaching the required form, AR4684.

- For post-secondary education tuition deductions, enter the total amount and attach any necessary forms, like AR1075(s).

- Complete the 'Miscellaneous Deductions' section. Add unreimbursed employee expenses and any other stated expenses to calculate total miscellaneous deductions, ensuring to follow the 2% AGI limit instructions.

- Finally, calculate the total itemized deductions by adding all relevant totals from previous sections, then follow any additional instructions for your specific filing status, if applicable.

- Once all fields are filled out, you can save your changes, download a copy, print the form, or share it as needed.

Complete your AR AR3 form online today for a smoother tax filing experience.

By law, most temporary visa holders and even lawful permanent residents are required to inform USCIS when they change their residential address. The address change notification must be sent to USCIS within 10 days of moving.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.