Loading

Get Mn Dor M1prx 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR M1PRX online

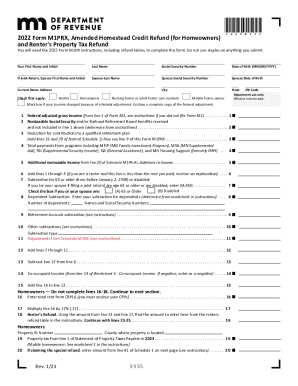

The MN DoR M1PRX is the Amended Homestead Credit Refund and Renter's Property Tax Refund form used to correct prior submissions. This guide offers a clear, step-by-step approach to help you fill out the M1PRX online efficiently, ensuring you provide all necessary information accurately.

Follow the steps to complete the MN DoR M1PRX form online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your first name and initial in the designated field, followed by your last name.

- Input your Social Security number to validate your identity.

- Provide your date of birth in the format MM/DD/YYYY.

- If filing jointly, enter your spouse's first name, initial, last name, Social Security number, and date of birth.

- Fill in your current home address, including city, state, and ZIP code.

- Select the appropriate box to indicate whether you are a renter, homeowner, nursing home resident, or mobile home owner.

- If your income has changed due to a federal adjustment, check the appropriate box and attach a full copy of the federal adjustment.

- Complete lines 1 through 5, entering your Federal Adjusted Gross Income, nontaxable benefits received, retirement plan deductions, total payments from assistance programs, and additional nontaxable income.

- Add lines 1 through 5 and enter the total on line 6. If this amount is less than your rent (for renters), include an explanation.

- If you or your spouse are age 65 or older or disabled, enter $4,450 on line 7.

- On line 8, enter any subtractive amounts for dependents and include their names and Social Security numbers.

- Follow guidelines for retirement account subtractions and complete any other necessary reductions, continuing down to line 12.

- Subtract line 12 from line 6 and record the result on line 13.

- Proceed through the homeowner or renter specific sections, depending on your status, adding required information.

- For homeowners, fill in property tax information and details regarding any special refunds as prompted.

- Finalize the form by reviewing all information for accuracy, ensuring all required documents are attached, and completing the signature section.

- Save your changes, then download, print, or share the completed form as needed.

Complete your MN DoR M1PRX submission online today for an accurate and timely processing of your refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.