Loading

Get Mn M99 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN M99 online

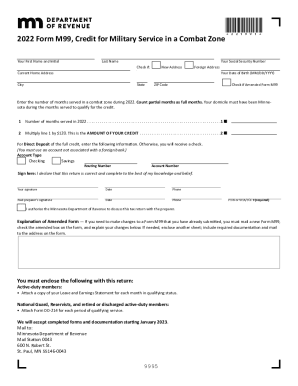

The MN M99 form is designed for individuals seeking a tax credit for military service in a combat zone during the year 2022. This guide provides a step-by-step approach to help you complete the form accurately and efficiently.

Follow the steps to fill out the MN M99 online:

- Press the ‘Get Form’ button to access the MN M99 form and open it in your preferred editor.

- Begin by entering your first name and initial as well as your last name in the designated fields.

- Provide your Social Security number and indicate if you have a new or foreign address, as well as your current home address.

- Fill in your date of birth in the specified MM/DD/YYYY format.

- Enter your city, state, and ZIP code.

- If applicable, check the box indicating that this is an amended Form M99.

- Record the total number of months you served in a combat zone during 2022 in the corresponding field.

- Multiply the number of months entered in the previous step by $120 to calculate the amount of your credit.

- If you wish to receive a direct deposit of your credit, complete the banking information sections, ensuring that the account is not associated with a foreign bank.

- Sign and date the form, confirming the accuracy of your submission.

- If applicable, have your paid preparer sign the form and include their information.

- If you need to amend a previously submitted form, check the amended box and provide an explanation for the changes.

- Gather all necessary documentation to attach with your form, including Leave and Earnings Statements or DD-214 forms.

- Finally, save your changes, then download and print the completed form to mail it to the address provided.

Complete and file your MN M99 online to claim your tax credit for military service.

For most taxpayers, that'll be your return for the 2019 tax year which, by the way, will be due on April 15, 2020. The 2019 tax rates themselves are the same as the tax rates in effect for the 2018 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.