Loading

Get Tx Trs 228a 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX TRS 228A online

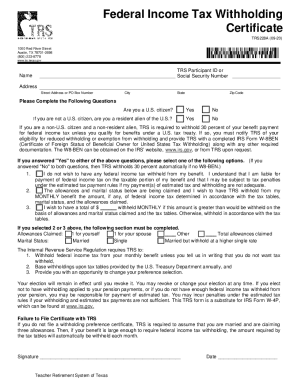

The TX TRS 228A form is essential for managing federal income tax withholding for participants in the Teacher Retirement System of Texas. This guide will walk you through the process of filling out the form online, providing clear instructions for each section to ensure accuracy and compliance.

Follow the steps to fill out the TX TRS 228A online.

- Click the ‘Get Form’ button to access the TX TRS 228A form and open it in your online editor.

- Enter your TRS Participant ID or Social Security Number in the designated field to identify your record.

- Fill in your full name, including your first name, middle initial, and last name.

- Provide your complete address, including street address or PO Box number, city, state, and zip code.

- Answer the citizenship questions: Select 'Yes' or 'No' for whether you are a U.S. citizen, and if applicable, indicate if you are a resident alien.

- If you are not a U.S. citizen or are a non-resident alien, be aware that TRS will withhold 30 percent of your benefit unless you qualify for reduced withholding under a U.S. tax treaty. If eligible, you must notify TRS and submit a completed IRS Form W-8BEN.

- Based on your answers, select one of the options for federal income tax withholding preferences. Choose whether you want no withholding, wish to have the standard amount withheld based on allowances and marital status, or specify a different monthly withholding amount.

- If you choose options 2 or 3, complete the allowances section by indicating allowances for yourself, your spouse, and any other applicable allowances.

- Select your marital status: Married, Single, or Married but withhold at a higher single rate.

- Review the required statements from the IRS regarding withholding preferences. Make sure to understand the implications of your choices.

- Sign and date the form to confirm your preferences and submission.

- Once complete, you can save your changes, download the form, print it, or share it as necessary.

Complete your TX TRS 228A form online today to manage your federal income tax withholding effectively.

The Rule of 80 It means that once an employee's age and years of service total 80, the employee is eligible to retire. Here is an example. An employee begins working for a government agency at age 27. The organization's retirement system operates under the rule of 80.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.