Loading

Get Tx Comptroller 50-144 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-144 online

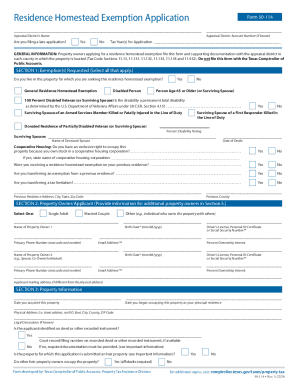

The TX Comptroller 50-144 form is essential for property owners seeking a residence homestead exemption in Texas. This guide provides clear, step-by-step instructions to help you accurately complete and submit the form online.

Follow the steps to successfully complete the TX Comptroller 50-144 form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Indicate if you are filing a late application by selecting 'Yes' or 'No'. Then, enter the tax year(s) for which you are applying.

- In Section 1, select all exemptions you are requesting, and confirm if you live in the property by selecting 'Yes' or 'No'.

- Provide your personal details in Section 2, including your name, birth date, and contact information. If applicable, provide information for additional property owners.

- In Section 3, fill in the property information, including the date you acquired and began occupying the property, the physical address, and any legal descriptions.

- Complete Section 4 regarding the waiver of required documentation. Select if you are exempt from providing a driver’s license and give details about your circumstances.

- If you have additional information, provide it in Section 5. This can include information about other residential properties you own in Texas.

- In Section 6, provide your affirmation and signature to verify the truthfulness of the information you provided. Include the date.

- Once the form is completed, save your changes, download, print, or share the form as needed.

Start filling out your TX Comptroller 50-144 form online today to ensure you receive your residence homestead exemption.

Seniors who fill out Form 1040SR must take the standard deduction. Remember that if you're 65 or over, you are entitled to an additional $1,300. For an individual, that would raise the standard deduction to $13,300 for the tax year 2019, the first year that you can use the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.