Loading

Get Tx Form 50-129 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Form 50-129 online

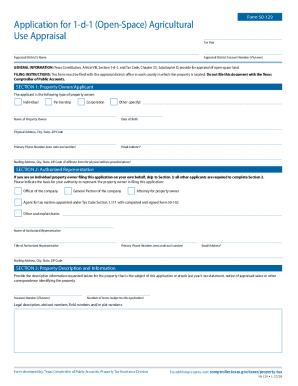

Filling out the TX Form 50-129 online is an important step in applying for open-space agricultural use appraisal. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the TX Form 50-129.

- Press the ‘Get Form’ button to access the TX Form 50-129 and open it in your preferred editor.

- In Section 1, provide your personal information, including your name, date of birth, physical address, phone number, and email address. If your mailing address differs, include that as well.

- If you are not filing as an individual, complete Section 2 with your authorized representative's details, including their name, title, phone number, and mailing address.

- Move to Section 3 and enter the property description including the account number, acreage, and legal description. Ensure accuracy as this information is essential for the appraisal district.

- In Section 4, detail the property’s agricultural use for the past five years. List the agricultural land categories, the number of acres for each use, and any livestock or crops.

- If applicable, complete Section 5 regarding wildlife management practices, indicating the practices implemented and whether there is a wildlife management plan.

- Should your property have transitioned to timber production, address this in Section 6 with the date of conversion and your wishes regarding appraisal.

- Finally, in Section 7, certify the application by signing and dating it. Ensure that all information provided is truthful and accurate.

- Once you have filled out all necessary sections, you can save your changes, download the document, print it, or share it as needed.

Complete your TX Form 50-129 online today to ensure your agricultural appraisal is filed on time.

A Texas Agricultural Tax Exemption can be used as a land owner uses their land for hay production, raising livestock or managing wildlife. ... Applicants are not eligible if they don't do these things on a regular basis including home gardening, horse racing or certain types of wildlife management and land conservation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.