Get Ky Dor 10a100 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY DoR 10A100 online

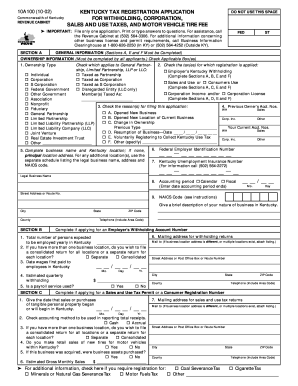

The KY DoR 10A100 is the Kentucky Tax Registration Application for withholding, corporation, sales and use taxes, and motor vehicle tire fee. This guide will provide you with a clear and comprehensive step-by-step approach to filling out this important document online.

Follow the steps to successfully complete your KY DoR 10A100 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Section A by providing general ownership information. Ensure you check the applicable boxes indicating the ownership type and the type of tax registration you are applying for.

- In Section A, you will also need to specify the reasons for filing this application. Fill out any previous account numbers if applicable and input your business name and Kentucky location.

- For Federal Employer Identification Number and Kentucky Unemployment Insurance Number, fill in the respective fields clearly and accurately.

- Indicate your preferred accounting period in Section A, whether it is calendar or fiscal, and specify the NAICS code along with a brief description of your business in Kentucky.

- In Section B, if you are applying for an employer's withholding account, complete the required information regarding employment expectations, payroll service usage, and estimated quarterly withholding amounts.

- Similarly, if you're applying for a sales and use tax permit in Section C, you need to provide the starting date for sales in Kentucky and choose your accounting method.

- In Section D, all corporations must include their date and state of incorporation, alongside any additional information requested for affiliated corporate groups.

- Complete Section E by answering whether your business owns or leases property or has employees in Kentucky. This provides essential insights into your business structure.

- Finally, ensure all necessary signatures are provided in Section F. Review all information for accuracy, then save changes, download, print, or share the completed form as required.

Start completing your KY DoR 10A100 form online today for an efficient tax registration process.

Get form

To fill out the Employee Withholding Certificate form, start by providing your personal information, including your name, address, and Social Security Number. Next, follow the instructions carefully to determine your filing status and any allowances for withholding. Utilizing resources like the KY DoR 10A100 can help clarify this process, and Uslegalforms offers templates that can guide you through properly completing the form.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.