Loading

Get Ca Schedule Ca (540) Instructions 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Schedule CA (540) Instructions online

Filling out the CA Schedule CA (540) is essential for making necessary adjustments to your federal adjusted gross income according to California law. This guide offers clear, step-by-step instructions to help users navigate the form online.

Follow the steps to fill out the CA Schedule CA (540) Instructions online

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

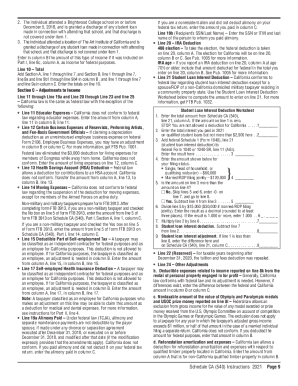

- Begin by reviewing the general information section of the form, which outlines the purpose and requirements for filing the Schedule CA (540). Take note of any recent changes to tax laws that may affect your filing process.

- Next, fill in Part I, Income Adjustment Schedule. For Column A, enter your federal amounts as reported on your federal Form 1040. This includes wages, taxable interest, and other income lines as instructed.

- In Columns B and C, make any necessary entries for additions and subtractions per California law affecting your federal income. Use the guidelines provided in the specific line instructions to identify the correct adjustments.

- Proceed to Section B of Part I for additional income adjustments, if applicable. Follow the same format as the previous section when entering amounts in Columns A, B, and C.

- Complete Section C to make adjustments to your income. Pay particular attention to instructions related to alimony, self-employment taxes, and other specified adjustments.

- Once all sections are completed, review your entries for accuracy. Make sure to check all required fields and calculations.

- Finally, save your changes, and prepare to download, print, or share your completed form as required for submission.

Complete your CA Schedule CA (540) Instructions online now.

For married taxpayers filing jointly and surviving spouses with a dependent child, the rates range from 1.0% of the first $17,088 of taxable income (formerly, $16,446 for 2017) to 12.3% of taxable income that is $1,145,960 and over (formerly, $1,102,946 and over for 2017).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.