Loading

Get Irs Instructions 1040 Schedule C 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instructions 1040 Schedule C online

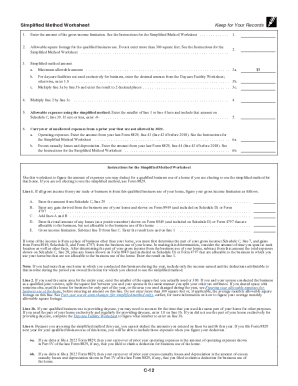

Filling out Schedule C (Form 1040) online is essential for sole proprietors reporting their business income or loss. This guide will walk you through the various sections and fields of the form, ensuring a clear understanding of each step.

Follow the steps to accurately complete Schedule C online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide a brief description of your principal business or professional activity on Line A. Include the type of product or service offered.

- For Line B, enter the six-digit code from the Principal Business or Professional Activity Codes chart that corresponds to your business activity.

- On Line D, enter your Employer Identification Number (EIN), if applicable; otherwise, leave it blank.

- Input your business address on Line E. If you operate your business from home, this line is optional.

- Select your accounting method on Line F. Decide between cash, accrual, or another method permitted by the IRS.

- For Line G, check 'Yes' if you materially participated in the business, as this affects your passive activity loss limitations.

- Fill in Lines H and I regarding business initiation and any payments requiring Form 1099, respectively.

- In Part I, report your income. Start with total gross receipts on Line 1, subtract any returns and allowances on Line 2.

- Proceed to Part II to enter your business expenses. Complete relevant lines such as vehicle expenses on Line 9, contract labor on Line 11, and other deductions.

- Calculate your net profit or loss by filling out Line 31 based on revenues and expenses entered.

- Once completed, save your changes and download, print, or share the form as needed.

Complete your IRS Schedule C online today to ensure your business reporting is accurate and timely.

QBI is the net amount of qualified items of income, gain, deduction and loss from any qualified trade or business, including income from partnerships, S corporations, sole proprietorships, and certain trusts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.