Loading

Get Pa Pa-8879 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA PA-8879 online

The PA PA-8879 is a crucial form for taxpayers in Pennsylvania to authorize electronic filing of their tax returns. This guide provides clear instructions on how to complete the PA PA-8879 online, ensuring a smooth and compliant filing process.

Follow the steps to fill out the PA PA-8879 online seamlessly.

- Click ‘Get Form’ button to download the PA PA-8879 and open it in your preferred PDF editor.

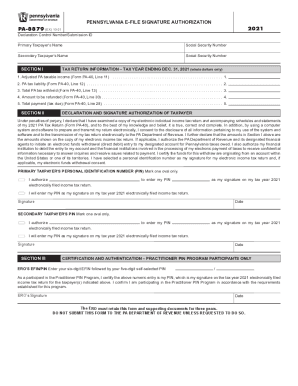

- In Section I, enter the primary taxpayer's name and social security number. If applicable, fill in the secondary taxpayer's name and social security number.

- Provide the tax return information for the tax year ending December 31, 2021. Input the adjusted PA taxable income from Form PA-40, Line 11, in the designated field labeled as 1.

- Next, enter the PA tax liability from Form PA-40, Line 12 into field 2.

- Input the total PA tax withheld from Form PA-40, Line 13 in field 3.

- For field 4, fill in the amount to be refunded based on Form PA-40, Line 30.

- In field 5, enter the total payment (tax due) from Form PA-40, Line 28.

- Move to Section II to declare and authorize the information. Read the statement and ensure accuracy regarding your information and consent to electronic transmission.

- Choose one option regarding the personal identification number (PIN). Mark the appropriate oval indicating whether you authorize a third party to enter your PIN or if you will enter it personally.

- Sign the form in the designated area for the primary taxpayer, including the date.

- If applicable, complete the section for the secondary taxpayer following the same procedure. Mark the options regarding the PIN and sign as requested.

- If participating as a practitioner, fill out the certification information, including your ERO’s EFIN and self-selected PIN.

- Finally, review the completed form for accuracy and save any changes made. You may download, print, or share the document as needed.

Complete your PA PA-8879 online today to ensure timely and accurate tax submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

How do I get a copy of a previously filed PA Income Tax Return? If you are requesting the release of your own tax records, you may also fax your request to 717-783-4355.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.