Loading

Get Sc St-388 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC ST-388 online

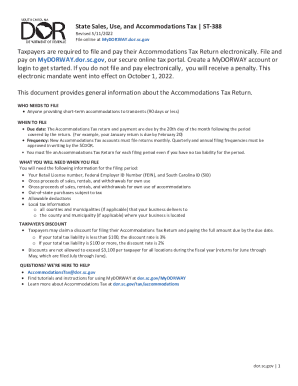

The SC ST-388 is an essential form for reporting sales, use, and accommodations tax in South Carolina. This guide provides a thorough overview and step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to effectively fill out the SC ST-388 online.

- Press the ‘Get Form’ button to access the SC ST-388 form and open it in your online editor.

- Begin filling out your name and contact information in the designated fields. Ensure that you use clear and accurate information to facilitate processing.

- In the section regarding tax liability, carefully indicate whether you have any tax obligations for the specified period. If unsure, consult resources or guidance available through the relevant authorities.

- Next, provide detailed information regarding sales and accommodations. Include all relevant figures and ensure they are reflective of your actual business operations.

- Review all entries to ensure accuracy and completeness. It is important that no fields are left blank unless explicitly stated as optional.

- Once you have confirmed that all information is correct, save your changes to retain progress or resume at a later time.

- Finally, download a copy of your completed form for your records. You may also choose to print or share it as required.

Complete and submit your SC ST-388 form online today to ensure compliance.

South Carolina's general state sales and use tax rate is 6%. In certain counties, local sales and use taxes are imposed in addition to the 6% state rate. ... The use tax can be conveniently reported on South Carolina's individual income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.