Loading

Get Mn Dor M4 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR M4 online

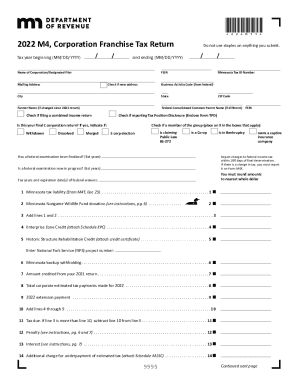

Filling out the Minnesota Department of Revenue's M4 form online can seem daunting, but with this guide, you will navigate the process with ease. This comprehensive overview provides step-by-step instructions to help you complete each section of the Corporation Franchise Tax Return.

Follow the steps to effectively complete the MN DoR M4 online.

- Click the ‘Get Form’ button to access the MN DoR M4 and open it in the online editor.

- Indicate the tax year at the top of the form, specifying the beginning and ending date using the format MM/DD/YYYY.

- Enter the name of the corporation or designated filer clearly in the designated field.

- Fill in the Federal Employer Identification Number (FEIN) to identify your corporate tax filings.

- Provide the mailing address of the corporation along with the Minnesota Tax ID number, if applicable.

- Mark the checkbox if you have a new mailing address.

- Input the Business Activity Code sourced from the federal return to classify your business activities.

- Complete the city, state, and ZIP code fields.

- If applicable, indicate any former names of the corporation and the Federal Consolidated Common Parent Name along with the FEIN.

- Select the appropriate checkboxes for combined income returns, tax position disclosures, and whether this is your final C corporation return, specifying conditions like 'Withdrawn', 'Dissolved', or 'Merged'.

- Input the necessary financial information, rounding amounts to the nearest whole dollar. This includes various income, deductions, and taxes applicable to Minnesota.

- Once all fields are completed accurately, save your changes using the provided options in the online editor.

- Choose whether to download, print, or share the completed form as per your requirements.

Start filling out your MN DoR M4 online today to ensure timely and accurate submission of your Corporation Franchise Tax Return.

Social Security income included in Minnesota taxable income (after subtraction) is taxed at the same rate as other kinds of income 5.35 percent, 7.05 percent, 7.85 percent, or 9.85 percent depending on the total amount of taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.