Get Hi Dot N-20 - Schedule K-1 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign HI DoT N-20 - Schedule K-1 online

How to fill out and sign HI DoT N-20 - Schedule K-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Confirming your earnings and declaring all the vital tax documents, including HI DoT N-20 - Schedule K-1, is a US citizen?s sole duty. US Legal Forms helps make your taxes managing more available and accurate. You can get any juridical forms you need and fill out them electronically.

How to prepare HI DoT N-20 - Schedule K-1 on the internet:

-

Get HI DoT N-20 - Schedule K-1 in your internet browser from your device.

-

Gain access to the fillable PDF document with a click.

-

Start completing the template field by field, following the prompts of the advanced PDF editor?s user interface.

-

Accurately type textual content and numbers.

-

Press the Date box to set the actual day automatically or change it manually.

-

Use Signature Wizard to make your custom-made e-signature and sign within minutes.

-

Check IRS instructions if you still have questions..

-

Click Done to confirm the edits..

-

Go on to print the document out, save, or send it via E-mail, text messaging, Fax, USPS without leaving your browser.

Store your HI DoT N-20 - Schedule K-1 securely. You should make sure that all your correct papers and data are in are in right place while bearing in mind the deadlines and tax regulations set with the Internal Revenue Service. Do it simple with US Legal Forms!

How to edit HI DoT N-20 - Schedule K-1: customize forms online

Get rid of the mess from your paperwork routine. Discover the most effective way to find and edit, and file a HI DoT N-20 - Schedule K-1

The process of preparing HI DoT N-20 - Schedule K-1 needs accuracy and attention, especially from people who are not well familiar with such a job. It is important to get a suitable template and fill it in with the correct information. With the proper solution for processing paperwork, you can get all the instruments at hand. It is easy to simplify your editing process without learning new skills. Locate the right sample of HI DoT N-20 - Schedule K-1 and fill it out instantly without switching between your browser tabs. Discover more tools to customize your HI DoT N-20 - Schedule K-1 form in the modifying mode.

While on the HI DoT N-20 - Schedule K-1 page, simply click the Get form button to start modifying it. Add your information to the form on the spot, as all the needed instruments are at hand right here. The sample is pre-designed, so the effort needed from the user is minimal. Simply use the interactive fillable fields in the editor to easily complete your paperwork. Simply click on the form and proceed to the editor mode immediately. Complete the interactive field, and your file is all set.

Try out more tools to customize your form:

- Place more text around the document if needed. Use the Text and Text Box tools to insert text in a separate box.

- Add pre-designed graphic elements like Circle, Cross, and Check with respective tools.

- If needed, capture or upload images to the document with the Image tool.

- If you need to draw something in the document, use Line, Arrow, and Draw tools.

- Try the Highlight, Erase, and Blackout tools to change the text in the document.

- If you need to add comments to specific document sections, click the Sticky tool and place a note where you want.

Often, a small error can wreck the whole form when someone completes it by hand. Forget about inaccuracies in your paperwork. Find the templates you require in moments and complete them electronically using a smart modifying solution.

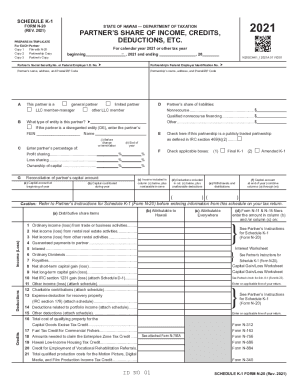

Use Schedule K-1 to report a beneficiary's share of the estate's or trust's income, credits, deductions, etc. on your Form 1040, U.S. Individual Income Tax Return. ... Don't file it with your tax return, unless backup withholding was reported in box 13, code B.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.