Loading

Get Ny Dtf Dtf-4 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF DTF-4 online

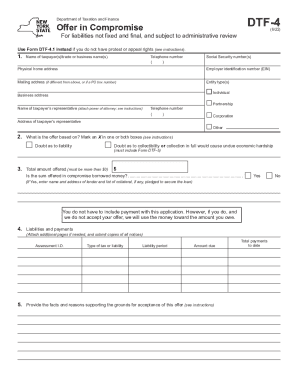

Filling out the NY DTF DTF-4 form is an essential step for taxpayers seeking to submit an offer in compromise. This guide will walk you through each section of the form, providing clear instructions to help you successfully complete it online.

Follow the steps to complete the NY DTF DTF-4 online.

- Press the 'Get Form' button to access the form and open it in the editor.

- Provide the name of the taxpayer or trade or business name. Enter the taxpayer's telephone number, Social Security number(s), physical home address, and employer identification number (EIN) if applicable. Include mailing address if it differs from the physical address. Specify the entity type by marking an 'X' in the relevant box—Individual, Partnership, or Corporation. If applicable, enter the name and contact information of the taxpayer’s representative and attach the power of attorney.

- Indicate the basis for your offer by marking an 'X' in one or both boxes under Section 2. Choose 'Doubt as to liability' if you believe the claim is incorrect, or 'Doubt as to collectibility' if you cannot pay the full amount or paying would cause economic hardship.

- Enter the total amount you are offering in Section 3. Ensure that this amount is greater than $0 and includes Form DTF-5 if applicable. Check the box if the offered amount comes from borrowed money and provide required details.

- List all unpaid liabilities you wish to compromise in Section 4. Include the assessment ID, type of tax, liability period, and amount due for each liability, and attach additional pages if necessary.

- In Section 5, clearly state the facts and reasons for your offer's acceptance. Provide all necessary details and supporting documentation to substantiate your claim.

- Read through the conditions listed in Section 6 to ensure compliance. Confirm your understanding and agreement.

- Sign and date the form in Section 7. If the offer is for a joint liability, both taxpayers must sign.

- Finally, save your changes and download, print, or share the completed form as needed.

Complete your NY DTF DTF-4 application online today!

You are entitled to this refundable credit if: Your household gross income is $18,000 or less. You occupied the same New York residence for six months or more. You were a New York State resident for the entire tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.